|

As a credit manager, did you come across a situation where you had to tell a salesperson to turn away a sale? The reason being the credit risk was way too high.

Secured transactions can help you deal with high past dues by leveraging the personal property assets of their customer. This course will help you leverage best practices to promote commerce, encourage lending and sales, and play a vital role in driving our economy.

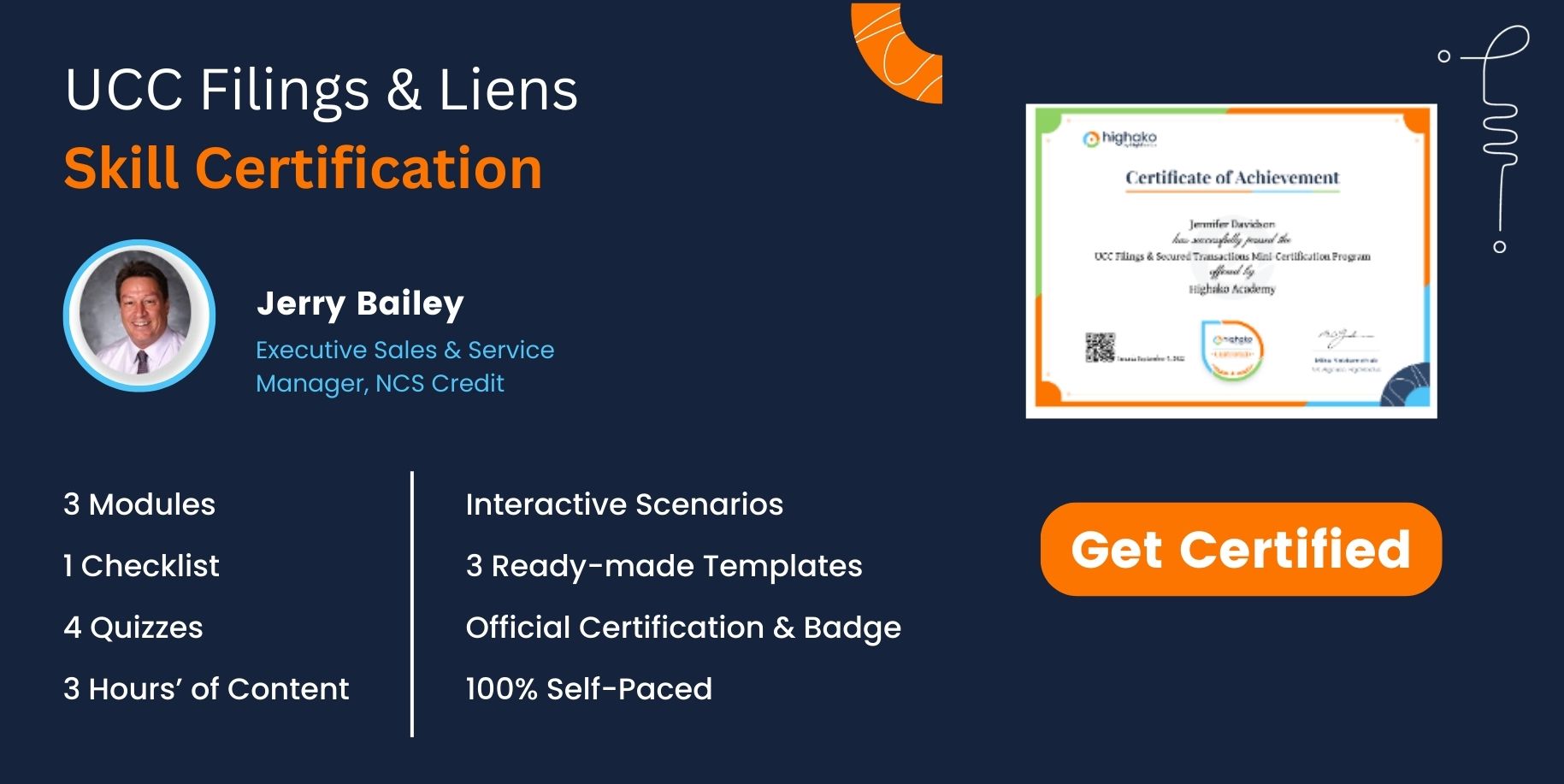

Join Jerry Bailey, Executive Sales and Education Services Manager for NCS, and discover how secured transactions can increase your sales while protecting your receivables.

Find out how to use secured transactions to increase your company’s sales:

- Sell to marginal accounts when you typically would not extend credit.

- Expand credit lines for customers that are exceeding their credit limit.

- Work with customers who are past due and need additional time to pay.

- Sell to a customer that places an order much larger than any in their history.

- Provide materials or services to a construction project when you have serious credit apprehensions.

- Implement credit promotional programs. Sales does it, why can’t we?

|