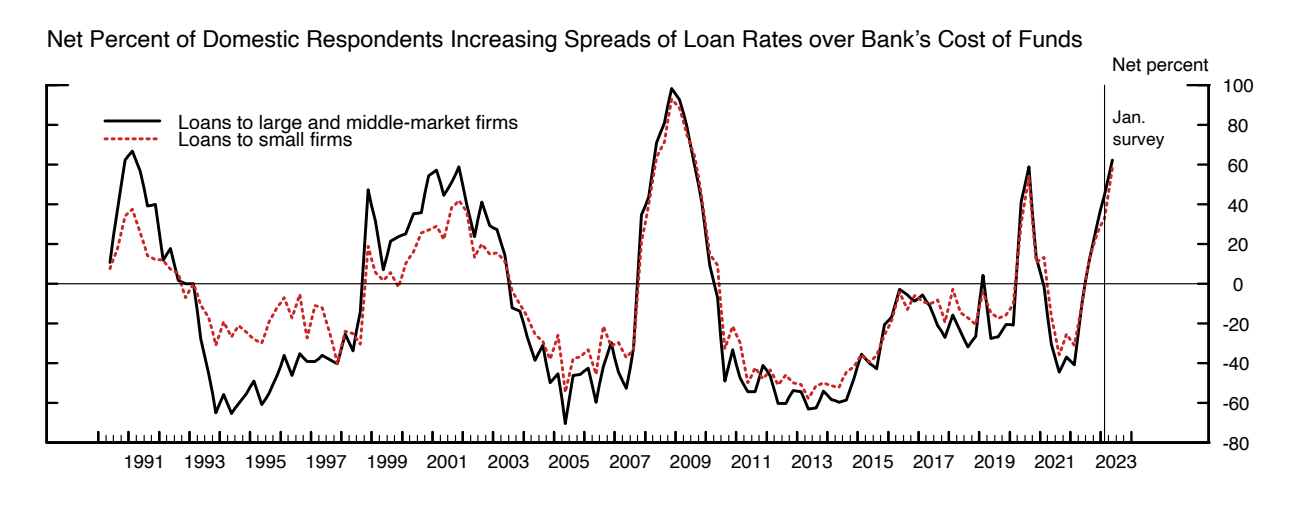

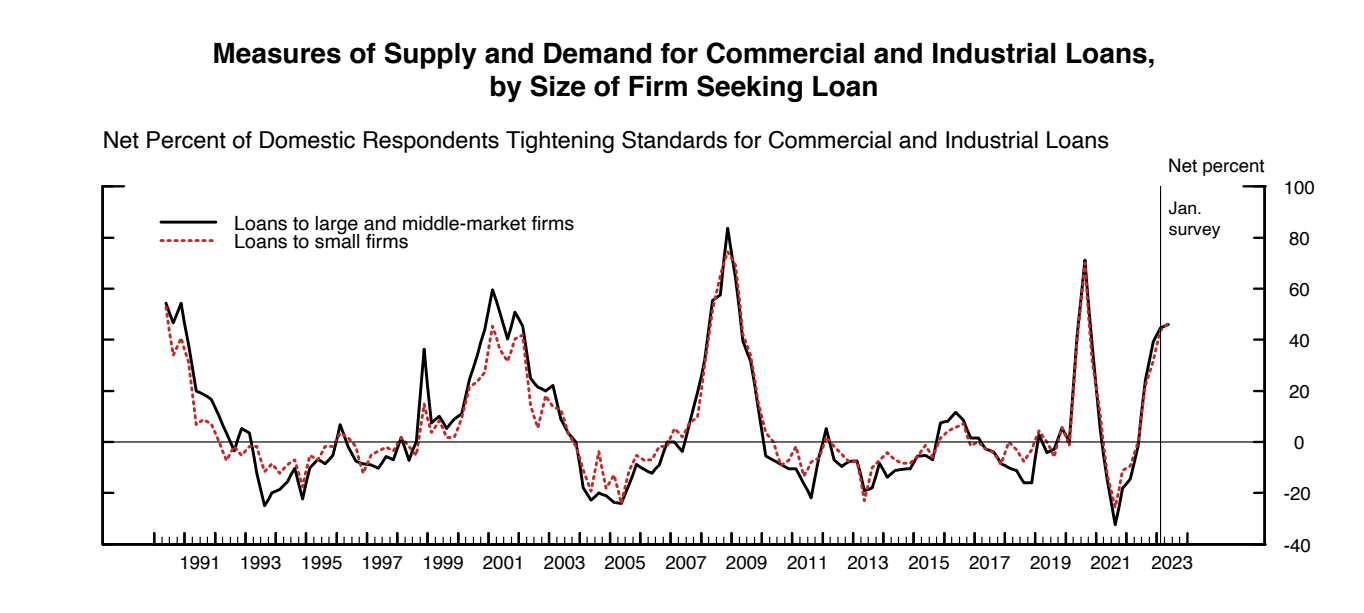

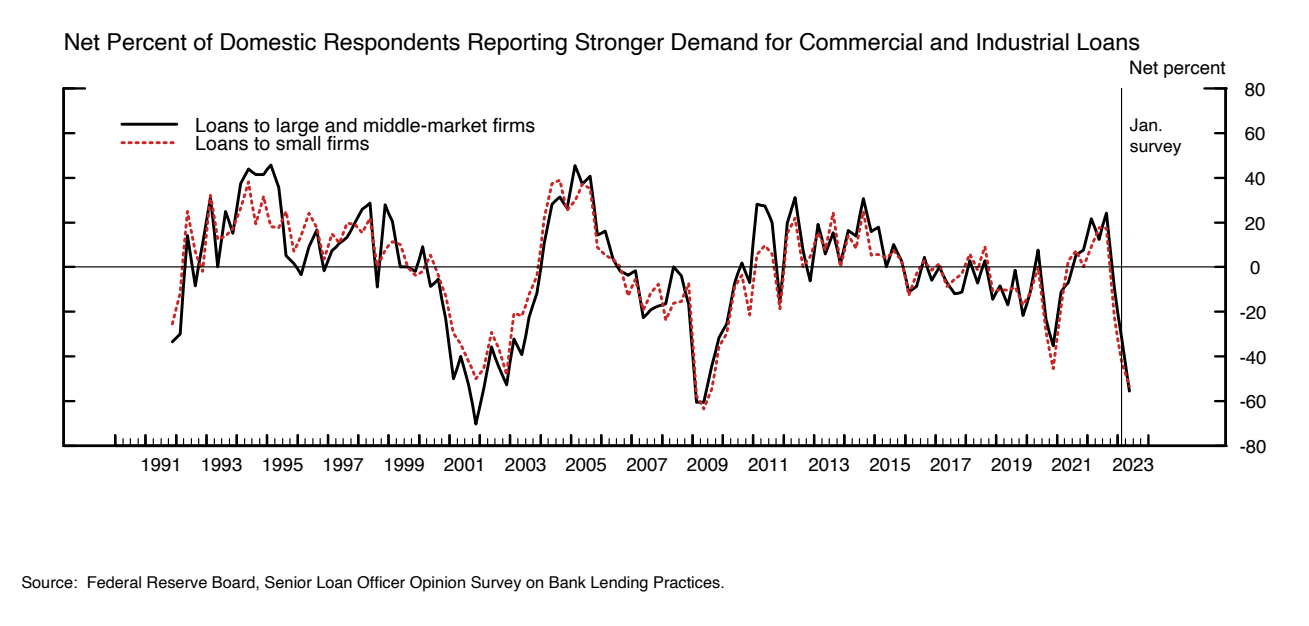

Because trade credit is affected by commercial lending, credit executives should keep an eye on what is happening in the banking industry. The following three charts come from the Federal Reserve Board’s, Senior Loan Officer Opinion Survey on Bank Lending Practices. They show that:

• Bankers are tightening their credit standards for both large and small firms

• Banks are charging a widening range of interest rates for their loans – In other words, the rates for firms with good credit are not going up as fast as for firms with higher credit risk

• Consistent with the above, demand for Commercial and Industrial (C&I) loans is dropping precipitously

• All these trends are consistent with what happened in previous recessionary periods.

When businesses cannot get bank loans, or cannot get loans at favorable rates, they often rely on their suppliers for capital by delaying payments and extending their Days Payables Outstanding (DPO). Read any recent article about managing cash flow written for CFOs and Treasurers and it is likely to talk about the need to increase DPO. Chances are your company’s executives are doing the same.

This is a battle that credit executives must fight over and over again, especially when there are recessionary headwinds. There is not much else you can do except be extra diligent, that is unless you can find a way to follow the bankers’ lead and charge a risk premium.