Credit Today ListServ: SnapShot Survey on AR Dashboard Utilization

Dashboards contain key performance indicators (KPIs) that provide a quick reference for how a company or a specific function such as credit is performing. In the case of credit, dashboards containing credit metrics can be used within the credit organization (internally) to track performance as well as provide other functions (such as sales, finance, or administration) with an interest in monitoring AR performance.

We recently conducted a couple of surveys on KPIs. One looked at Key Financial Performance Indicators and the other at Key Process Performance Indicators. In those surveys, we touched on dashboards, but with this survey we wanted to get some more information about how dashboards are utilized in credit organizations.

Observations:

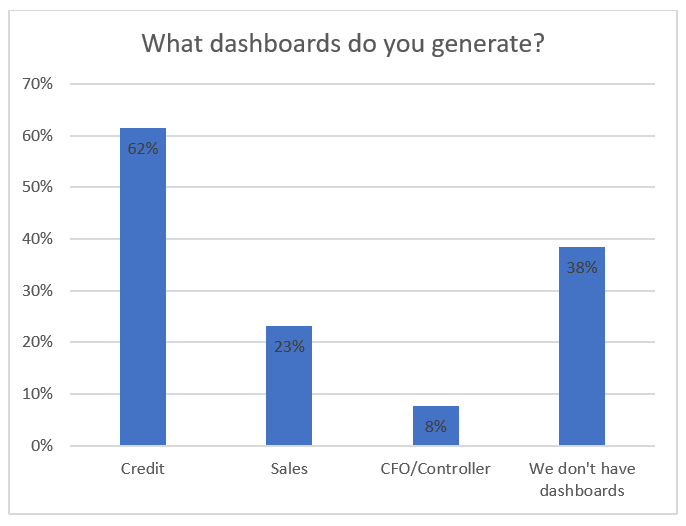

- Of the 62 percent of survey participants that have a credit dashboard, slightly over one-third also have a Sales and/or Finance (CFO/Controller) dashboard

- Nearly 2 out of 5 organizations do not have any dashboards, an indicator that they have little to no AR automation beyond their AR (billing and remittance processing) software module

Observations:

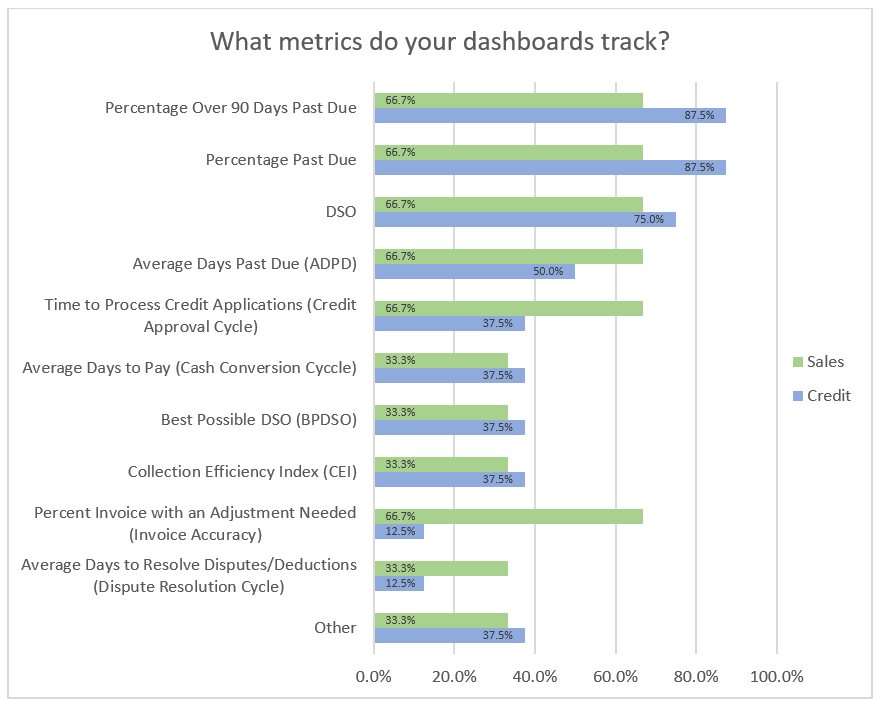

- Unsurprisingly, information on Past Dues and DSO topped the list for inclusion in credit dashboards

- These items are important for sales as well, but that function also showed an elevated level of interest in the credit approval cycle and invoice accuracy, which is understandable

- Other information reported on credit dashboards included:

- Percent Current

- Top 25 Companies

- Working Capital and Working Capital Turnover

- Over 30 Day AR

- Over 120 Day Inventory

- Other information reported on sales dashboards included Open to Buy (unutilized credit available)

- Because of the small sample size, no conclusions could be made about CFO/Controller dashboards

Question: Please tell us about your dashboards. How much of a challenge did they take to create? Are they configurable? What are the benefits you have realized by having a dashboard?

“Our reporting dept was able to extract the data from our ERP system and create a "story" in Analytics. The benefit is that upper management can see them at any time – no waiting for an excel sheet or something to be sent around.” – Todd Blackburn, Customer Brands Group (Division of Hunter Douglas)

“I created them years ago; the only challenge was setting up the formulas. These numbers get reported to the executive each month. The benefits are that you can see trends and readjust your process if necessary.” – Michelle Wilson, Credit & Collections Manager, BEGA USA Inc.

“Creating the dashboard was fairly easy, but I am still learning how to use the different dashboard features to be more efficient and look at others that need to be added. The benefits, I see information quickly and can address and resolve issues faster.” – Cindy Jacobs, Credit Manager, Quorom International

Demographics

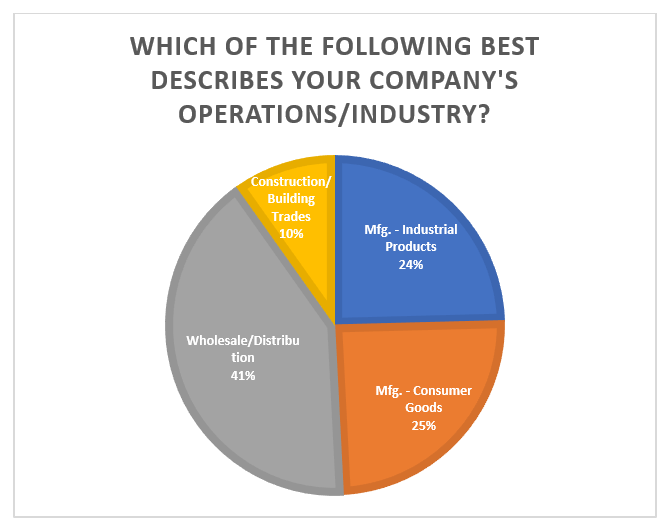

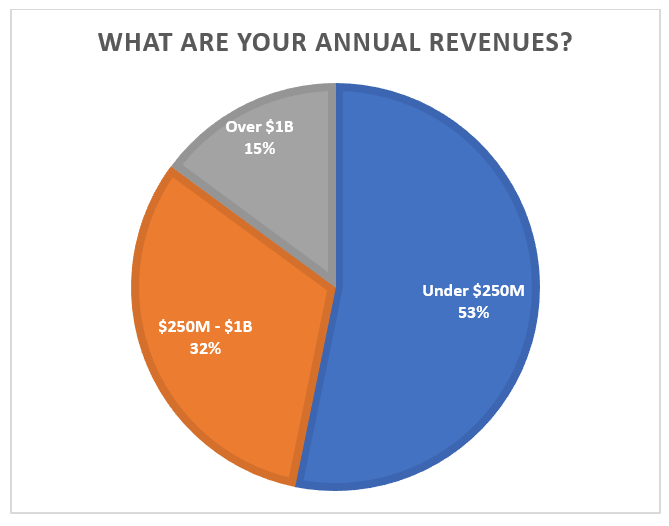

Survey Participants: 13