Executive Summary

To be competitive, businesses have to manage all customer-facing processes in a way that delivers an excellent customer experience (also known in today's parlance as CX). In every industry, there are numerous purchasing options. Unlike in the past, buying decisions now go beyond product quality, delivery time, and cost. These are certainly critical to any buying decision, but customers are looking for more.

Today a seller has to deliver a buying experience that is simple and seamless. Customers expect efficiency, accuracy, and excellent customer service. If a seller fails to deliver these, but a competitor does, the customer may move to another seller who is easier to deal with, one that can be relied on to provide a consistently excellent buying experience. One that does not require an administrative load to unravel errors in delivery or invoicing and is responsive when problems do occur. All points of inefficiency and “friction” need to be quickly identified and corrected.

The order-to-cash (O2C) process directly impacts every customer transaction and relationship. As a Credit Manager, you have a critical role in both customer service and how your company adopts, implements, and uses the technology needed in today's fast-changing business climate.

To be successful the O2C process has to deliver excellent customer service, and that requires leveraging the Digital Transition now taking place. To be successful a credit manager needs to adopt, implement, and manage these changes in a way that best benefits your company and its customers.

A Common Theme

All aspects of the order-to-cash (OTC) cycle have one thing in common: they are customer-facing processes. Customer service is an often unrecognized value contribution by the credit team. Each OTC step interacts directly with your company's customers. For example, if the phone rings and is not answered, or the person responding is rude, or ill-informed; if emails go unanswered; if credit decisions take too long; if orders are booked incorrectly leading to invoice errors and deductions; if remittances are not booked in a timely fashion or incorrectly; each of these instances will influence how a customer perceives your company. Good perceptions are critical in a competitive marketplace.

Given all the purchasing tools we use as consumers, especially on our smartphones, it should come as no surprise that business people today also lack patience for any kind of friction or delay in the purchasing experience. Nobody wants to spend time addressing issues that should not have occurred in the first place. The challenge with B2B transactions is how each of the numerous points of contact between the seller's organization and that of the buyer needs to coordinate seamlessly.

To deliver a quality CX and compete today, companies must be efficient, responsive, and accurate. A key element of competitiveness derives from how well your company manages both the CX and the new technologies now being widely adopted. As it turns out, focusing on your customer's experience as you implement technology solutions across the O2C process will not only advance your firm's competitive position in the marketplace but will also drive Digital Transformation (DT) and accelerate accounts receivable AR performance to a whole new level.

Two of the big-picture trends driving corporate excellence are Digital Transformation (DT) and Customer Experience (CX). Credit professionals need to understand how these initiatives will affect their roles.

-

- What is CX? Customer Experience has long been a hot topic. It first gained a foothold in the retail sector during the 1980s. It extends from the belief that a competitive advantage involves more than just pricing and product quality. CX is derived from every point of contact between a business and its customers. In a seminal article published in Fast Company, Harley Manning and Kerry Bodine of Forrester Research outline the six disciplines for great CX: strategy, customer understanding, design, measurement, governance, and culture.

- What is DT? Wikipedia defines Digital Transformation as “the adoption of digital technology to transform services or businesses, through replacing non-digital or manual processes with digital processes or replacing older digital technology with newer digital technology. Digital solutions may enable, in addition to efficiency via automation, new types of innovation and creativity, much more than simply enhancing and supporting traditional methods.” Process automation has been a factor in business credit for over 25 years, though with the advent of Artificial Intelligence (AI) and Machine Learning (ML) it has been accelerating in recent years. The point is, much more can be done today, and better, than in the past, hence DT.

To date, process automation involving AR has for the most part been driven by the need to improve performance and control costs with little or no attention to CX. However, to realize the full promise of DT, it is crucial that CX be employed as the primary catalyst for improvement. The result will be, as stated in the aforementioned Wikipedia definition of DT, “new types of innovation and creativity, rather than simply enhancing and supporting traditional methods.” Up until now, DT has not significantly changed the way most credit departments interact within the order-to-cash process. Warning: Credit Managers need to realize credit and collections is in for a period of change.

- What is CX? Customer Experience has long been a hot topic. It first gained a foothold in the retail sector during the 1980s. It extends from the belief that a competitive advantage involves more than just pricing and product quality. CX is derived from every point of contact between a business and its customers. In a seminal article published in Fast Company, Harley Manning and Kerry Bodine of Forrester Research outline the six disciplines for great CX: strategy, customer understanding, design, measurement, governance, and culture.

Addressing Payment Friction is Critical

In 2019, The Hackett Group's “Customer-to-Cash Experience Poll” revealed that though 64 percent of organizations had a formal process for responding to customer feedback, most feedback was handled via phone calls or email. Just 50 percent reported their customers rated their service as either great or excellent. Traditionally, accounts receivable automation focused almost exclusively on increasing efficiency through the elimination of manual work. For example, organizations reduced costs by sending invoices electronically, using OCR to capture and automate check payments, and leveraging auto-matching capabilities for cash applications.

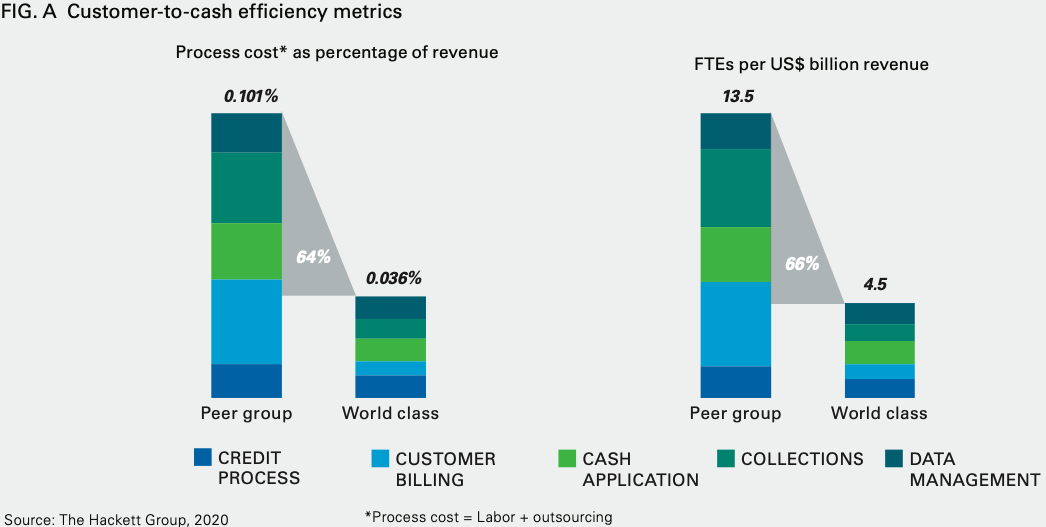

These first-generation efforts have paid off handsomely: The Hackett Group's data shows that world-class finance organizations, which exhibit higher automation levels, spend 64 percent less on the customer-to-cash process as a percentage of revenue and employ 66 percent fewer staff than typical organizations. Some of the biggest gaps between the two groups are in customer invoicing and collections (See FIG A). An important aspect that was lacking from these successful efforts to improve efficiencies was the element of customer centricity. It was not being considered and certainly was not being measured.

In the past, organizations focused on their product and services largely because customers bought from companies that delivered the best available. Now there is more to a buying decision. “The case now is, yes, your product is good, but if doing business with you is difficult, then I may consider my second choice. Maybe the second choice doesn't have the same bells and whistles, but you know what? Their invoices are always on time, and they're accurate, and I can go online to a great tool that they've provided me where I can see my invoices. I can pay them, or I can dispute them in real-time if something's not right and get it fixed quickly,” notes Bryan DeGraw, Associate Principal, of Financial Advisory Services, The Hackett Group.

This new focus on CX is far-reaching and involves every point of interaction across the order-to-cash process. “In finance, we see this transition, not just with external customers, but internally as well. This focus on the experience of the end user really differentiates the provider [who offers the better experience] from others who are selling a similar product. It's the differentiation between what's good and what's great,” observes Nilly Essaides, Senior Research Director, Finance, The Hackett Group.

This brings us back to the issue of the drivers for performance improvement. “The focus in the past was on optimizing processes within the finance organization, thereby saving us money on processing accounts receivables by automatically matching payments to the AR; however, right now there's sort of this leap into, what do my buyers need to make their AP work faster?” says Essaides. It's a complete flip of the coin, with AR performance now being best served by meeting the needs of AP.

Ecosystems and Information

“It's much more of an ecosystem approach with AP and AR linking up with each other in a more streamlined fashion. This collaboration is not just a reduction of friction, but also the sharing of information,” relates Essaides. Interconnectivity provides a trove of data insights. When that data reservoir is accessible to both buyer and seller, together they can look at things like frequency of payments or if dunning letters have gone out, and whether or not to send them out again.

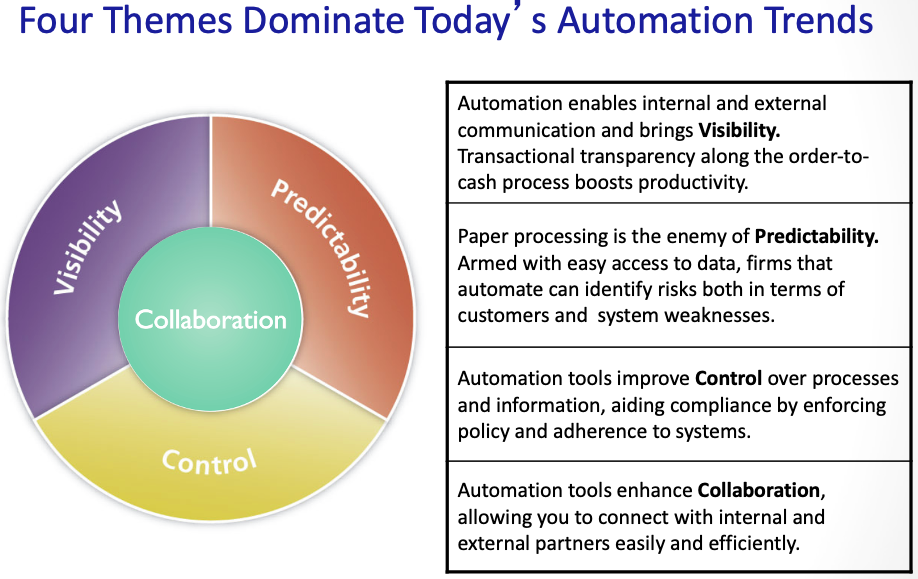

It becomes much easier to collaborate within a shared ecosystem that involves buyers and suppliers as well as payment processors and banks. First, there is shared visibility across the transactional database inclusive of supporting documentation. From visibility comes predictability. Everybody knows if an invoice has been approved for payment and when it will be paid. If the invoice has not been approved, everybody knows that too, and what needs to happen to get it approved? As such predictability in turn enables both AP and AR to have control over their processes and ultimately to collaborate with their counterparty in order to optimize processing.

FIG. B (Source: A2 Resources, used by permission)

Where Does Order-to-Cash Impact CX

While payment friction is at the heart of the problem, that is not the only issue impacting the customer experience. From a CX perspective, there are four themes that come into focus at the point a prospect becomes a customer. They are adoption, retention, expansion, and advocacy. Each is critical in the development of the customer from a buyer to a true trading partner. Keeping these in mind in relation to the O2C process illuminates opportunities to improve CX. Here are four key opportunities:

1. Credit Applications: These can be barriers to adoption when they are cumbersome and decisions take too much time. An online credit application process, that uses pre-fill data (from a credit bureau or other business information database) for both the applicant and references can make the application process much less cumbersome. Automating the decision process will address the timeliness issue in most cases, as well as pre-qualifying prospects when relatively large orders are at stake.

2. Order Holds: Customer retention can be affected when orders are unnecessarily held for review, thereby delaying shipment. An automated order review process needs to employ reasonable hold parameters so that the number of orders put on hold can be reviewed in a timely manner. If too many orders fall into the credit hold queue, the problem could stem from credit limits being set too tightly or collection efforts not keeping pace.

3. Credit Limit Reviews: Without regular reviews, credit limits can put a damper on customer expansion.

4. Invoice Accuracy and Deduction Resolution: These activities lead us back to the issue of payment friction. You must not only resolve deductions quickly but also work to eliminate the causes of deductions to improve your invoice accuracy. Conquer these areas and there is a good chance you will provide a superior CX and transform your customer into an advocate.

There are other industry-specific O2C components. The construction industry (think liens) and consumer goods manufacturers (think contract compliance) provide examples of two different universes. To reiterate the challenge AR organizations face, DeGraw states, “We've got to focus on the needs of the customer and then arm our organization and our team with the information and the tools needed to respond to issues with the customer's viewpoint in mind.”

The Onboarding Challenge

From an e-commerce perspective, the intersection of B2B buyers and sellers, of AP and AR, occurs at the juncture of invoices and payments. For some time now, both buyers and sellers have looked to Electronic Invoice Presentment and Payment (EIPP) Portals to deliver cost savings and processing efficiency, but neither side has paid much attention to the needs of their trading partners. A major burden faced by credit managers involves the challenge of submitting invoices to multiple types of AP invoice portals.

“Accounts payable has really led the way here,” asserts DeGraw. “They've tried to make AP efficient and effective. When they select a portal, they have a whole process to onboard their suppliers. It's not the same on the supplier side: The suppliers traditionally have really done whatever the customer has asked.”

Of course, you can't just say no to your customers or dictate how you want them to do business with your firm. DeGraw points out, “If I'm going to lead you to a system that doesn't have the advanced type of features and functionalities that are expected, then I'm not in a position to invite you to come into my portal.” Without customers' buy-in, suppliers face an uphill road.

“It's been very difficult to get buyers to enroll in supplier portals,” affirms Essaides. Her prescription is for suppliers to change their perspective. “There needs to be a new mindset within the seller's organization. They should run focus groups with customers to learn about their pain points, and only then come to the buyer with a solution that resolves their problems,” she asserts.

Your customers do not want to hear how much more efficient your firm will be if they enroll in your customer portal. They only care about how they will benefit. Will they be able to increase their automated match rates (their PO, your Invoice, their delivery receipt)? How can you help them quickly resolve exceptions? How can they generate more savings by taking discounts or getting more cash back on credit cards? These are the things that drive AP performance and credit executives need to address them as they evaluate their own systems.

Recommended Actions

Given the challenges of creating solutions that are a win for both the buyer and seller organizations, Essaides and DeGraw offer four recommendations for getting the job done right.

1. Offer Your Customers the Payment Modes They Favor: The idea is to make it easy for your customers to pay; one way to do that is to offer them a menu of payment options including checks, ACH, credit cards, mobile payments, and other alternative payment choices. Supplier solutions have fallen short because of limited payment modes, missing features, and a lack of embedded communication tools. “If you want customers to pay you, you've got to give them all the options available, and not just the ones that are best for you. Make sure you're doing your homework and understand what option your customers want to use. Obviously, you still need to be prudent about your offerings. You don't want your largest customers paying you with a credit card; it would be too expensive. So, you have to do it in a logical fashion,” says DeGraw. The goal is a true omnichannel payment solution.

2. Facilitate Greater Digital Engagement: There is synergy when both the AP and AR systems can communicate directly so information effortlessly flows in both directions. Standard communications (e.g., notifications and confirmations) should require no human intervention. “A direct linkage creates a whole new level of engagement between the two sides, and it's stickier. It is about more than just about getting the money in faster as a seller and delighting your customers at the other end: If you do that effectively, there is an additional connecting tissue between the two organizations that's going to be harder to break,” explains Essaides. That connection makes it more unlikely the buyer will be tempted to work with a new supplier.

3. Provide Total Process Transparency: When both the buyer and seller have full visibility into what their counterpart is doing, there will be fewer emails and phone calls. Collection efforts can be more targeted and thereby efficient. Both sides can use self-service features to validate account accuracy, and if there is a discrepancy, to also clarify and resolve invoice disputes. For example, “in some industries, like consumer goods, there are contracts designed with accelerators for discounts. If you bundle products, you get another discount layer. If you advertise online, in a paper, or magazine, there's an opportunity to get some type of marketing dollars back. All of that translates into a deduction on a payment, and if all of that information is transparent, then you save so lots of time on both ends in a transaction,” DeGraw explains. He adds that being able to communicate complete payment details speeds up the whole process. “The payment is seamless, and then the application of that payment is seamless because the company has all the information.”

4. Integrate Communications into the Platform: The idea is to create a centralized communication hub that facilitates online discussions across the entire transaction lifecycle. It brings us“back to this idea of an ecosystem, where there's a fabric of data that connects AR and a universe of customers. In-app communication means that you're seeing a problem, and it's just like we do in our personal lives when we get into a bank website and the chat box pops up on the side. It's a lot easier to share the information more quickly in-network. This form of interaction is more efficient for sellers because they get paid faster, resolve disputes more quickly, and make fewer collections calls. However, the ease of communication also feeds into the sense of stickiness in a relationship, as customers get immediate responses. Overall, it shortens the entire response cycle,” concludes Essaides.

Buying into the Concept

While this approach to receivables management improvement may pass muster with most credit executives from a process perspective, there is certain to be concern regarding the effect on staffing. Fig. A illustrated a 66 percent reduction in staff per billion dollars in revenue at world-class finance organizations that have transformed AR in this way versus their peer group. The performance and labor savings can be huge.

What that means is they have made a sea change in how AR is managed with a corresponding shift in the focus of the credit staff. Besides requiring fewer collectors, the remaining staff will naturally be more focused on big-picture risk and process issues as opposed to one-off customer risks and transactional issues. Intelligent systems do the processing while people manage the process (not so many transactions). This will naturally align the transformed credit function more with the treasury.

To a large extent, the issues involved with using CX to improve AR performance extend beyond the credit function. “It touches on everything from bad receivables to insufficient levels of working capital to noting deterioration – a risk management approach where you can detect deterioration of payments very quickly to assess the creditworthiness of a customer,” says Essaides. Those are issues that require a CFO or Treasurer's buy-in, especially now that we're dealing with uncertain economic conditions. A lot of companies are having difficulties paying invoices, so they need to be on top of this like never before.

In reality, for the most part, the impetus for using CX to transform AR is going to come from the C-suite. The savings and performance opportunities are sure to get the attention of treasurer and CFOs. You may already be seeing this. As previously observed by Credit Today, payment technology is leading us in this direction as well (check out Will Emerging Payment Tools Transform Credit Management).

Final Thoughts

Beware of the pitfall some companies will make. You cannot transform AR by buying into various payment technologies and then failing to include the people who have to deal with the consequences. The credit team is uniquely positioned to understand the customer relationship because they routinely deal with the breakdowns that occur during the O2C process, which largely manifest themselves when customers make payments. Enterprises that are inclined to leave credit out of the purchasing and implementation process for new AR and payment technologies are destined to run into the brick wall known as the law of unintended consequences due to a lack of understanding of the CX.

For credit managers, the opportunity is to get out in front of the parade now. Start by researching the possibilities and do benchmarking with your industry peers. This knowledge can give you a place at the table as technology and process decisions are made. By taking the initiative to evaluate your AR from the perspective of how you can improve your customers' experiences, credit managers will secure a greater say in how your company approaches AR transformation as well as setting themselves and their companies up for tremendous success.