ListServ SnapShot Survey: Cash Forecasting

Cash is King, and as the cost of money (think interest rates) keeps rising, cash forecasting is receiving more and more attention. A company’s cash position is primarily affected by its access to capital (loans or investments), expenditures (reflected in Accounts Payables), and, Sales (reflected in Accounts Receivable). Of the three, companies probably have more opportunity and, therefore, the ability to increase liquidity by active AR management.

That should put Credit and Collections front and center in terms of corporate cash flow forecasting. The purpose of this survey is to find out to what extent that is actually the case.

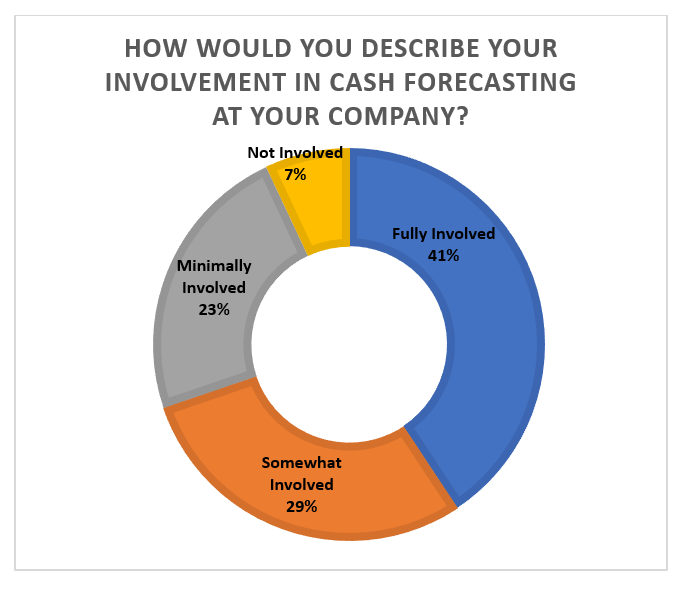

Observations:

• 93 percent of credit executives are involved in cash forecasting in one way or another

• 79 percent are significantly involved

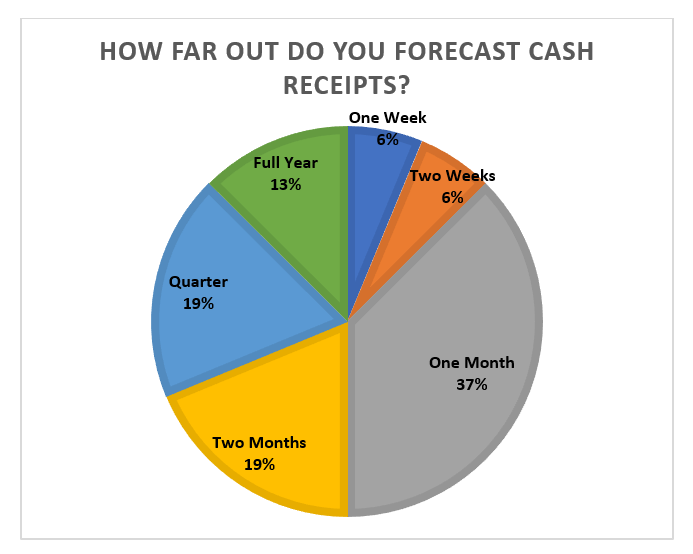

Observations:

• Only half of forecast cash receipts beyond the current month

• 75% forecast cash receipts for 1-3 months

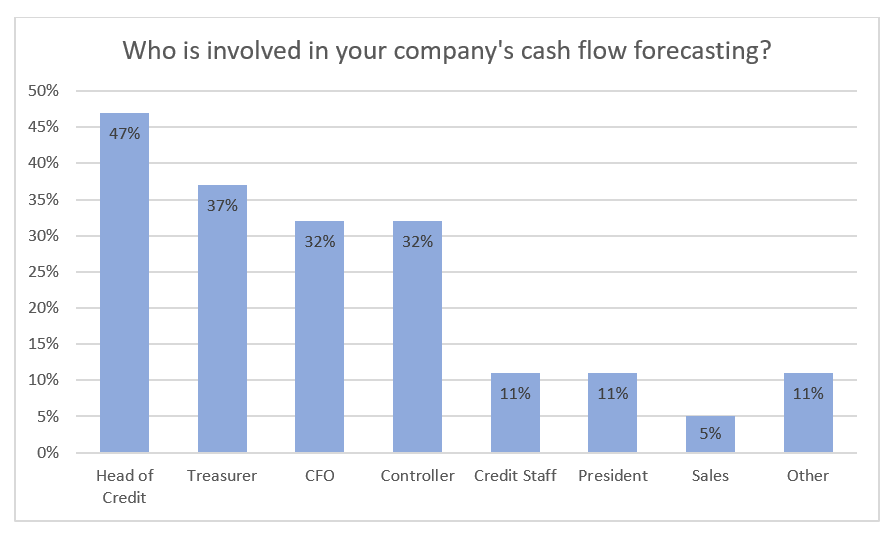

Observations:

• Other include VP and treasury staff

• It’s surprising that less than half report that the head of the credit department is not involved in cash forecasting

Question: Please tell us how you forecast cash receipts. What AR metrics do you use? What factors do you consider? Are you implementing AI to help with your forecasts?

“I would love to implement AI. Three warehouses are involved in my responsibility. I'm at corporate monitoring month end. Weekly a report is run, so I [share] what is past due and need to know why. I'm excited to have AI as a helpful tool.” - Pam Byk, Credit/Collections Manager, XL Screw Corp

“Very manually. Look at outstanding AR and forecast which will pay on time vs which will pay late based on due dates.” - Chris Finch, Retired, Sumitomo Electric Lightwave

“Historical trends, lockbox issues, and capabilities, ratio of monthly Sales to AR, industry impact & economic indicators.” - David Brian Bernardino, Director, McNichols Company

“We are using historical receipts and payables to forecast out 12 months. We build in any variables such as expected sales increases/decreases, as well as known events on the payable side. We are not utilizing AI.” - Tom Mazzarese, VP of Treasury & Credit, CCA Global Partners

“We are going to try and build an app in salesforce to do the cash forecasting.” - Anonymous

“Based upon open AR. When I worked in the corporate world and had a multi-million dollar AR, we would use trend analysis, shipping reports, special terms reports, and phone calls to make special payment arrangements.” Michael Margiotta, President, On Time Accounting

“Historical cash receipts, AI in the future will play a part.” - Doug Weller, Sr. Manager, Credit, Kelly Services

“Our system forecasts based on AR outstanding, terms and historical percentages collected.” - Tracey Skipp, Corporate Credit Manager, Magnussen Home Furnishings

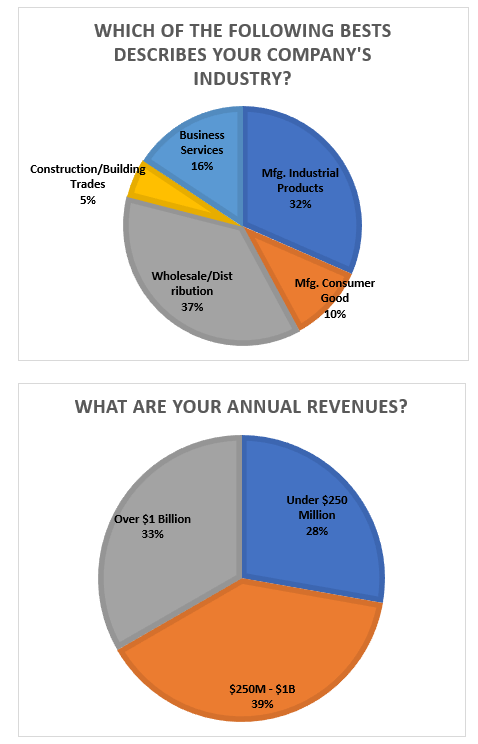

Survey Demographics

Total Participants: 19