ListServ: SnapShot Survey: Credit Hold Parameters

Since the approval of orders is a core credit control function, and an activity that takes up a considerable amount of time in most credit departments, we were interested in finding out the role automation plays in the credit hold and approval process. We also wanted to delve into some of the nuances related to credit holds including approval authority, release triggers, overrides, and cycle times.

We are pleased to report that 41 members of Credit Today’s ListServ participated in this survey. Please continue reading to learn the results.

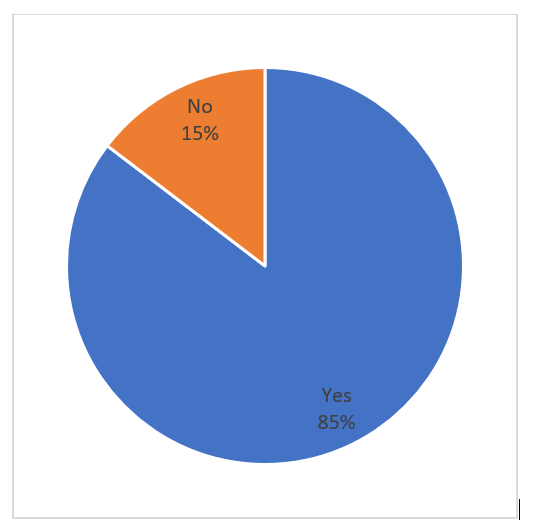

Does your company have an automated order approval mechanism that releases orders that meet specified parameters and puts those that don't on credit hold?

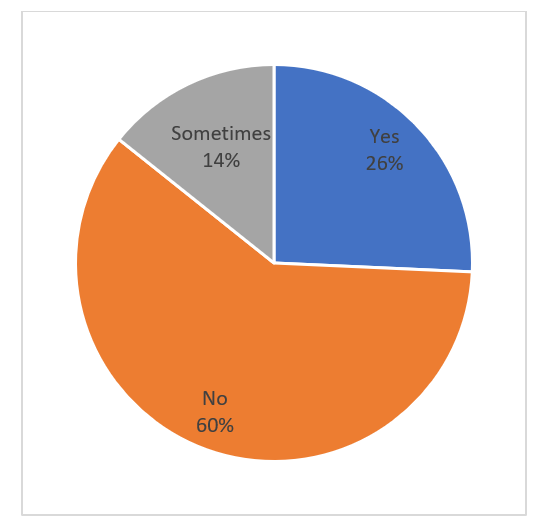

Are orders automatically released from Credit Hold when a payment is received that brings the customer account back within approval parameters?

Observations:

- Even though 85 percent reported having an automated credit hold mechanism, only 26 percent of that group reported having an automated release mechanism when payment is received and approval parameters then met

- We asked those indicating that in some instances the order would automatically be released to explain further:

- In several cases, the release would only occur after an update process was run, or the order re-indexed, often as part of the nightly stream

- Others involved a manual confirmation

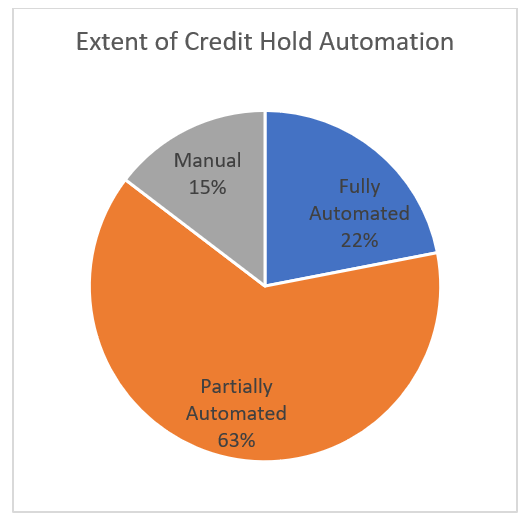

- Based on the information from the first two questions, we are able to conclude that only 22 percent of the organizations in our survey have fully automated the credit hold and approval process (see the following chart)

Observation:

- Automating the order approval and credit hold process is an area where nearly 4 out of 5 credit organizations can gain greater efficiency

- Programming order release protocols requires creating decision trees, which is a relatively simple process that does not require advanced digital tools or concepts.

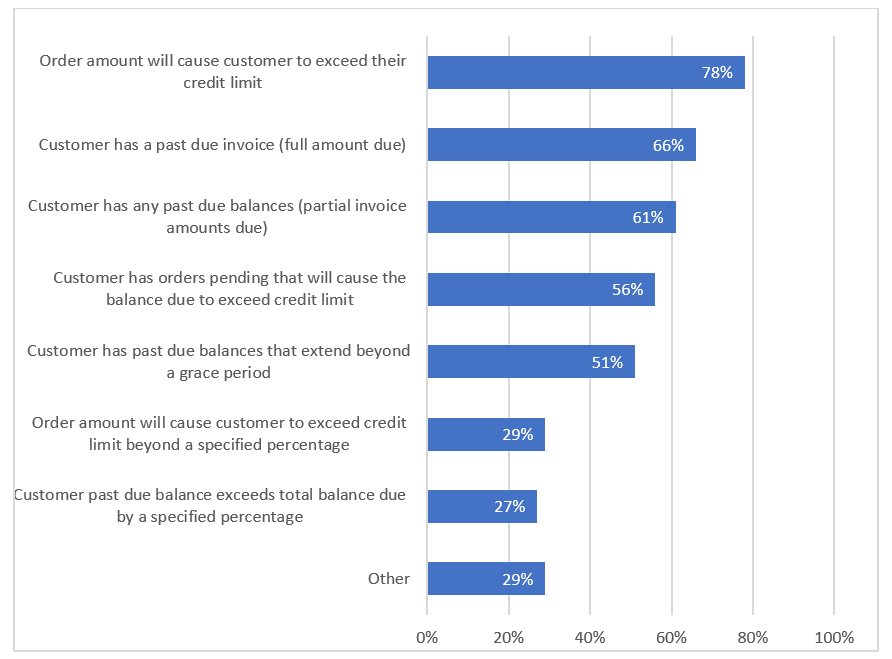

Which of the following criteria will cause a new customer order to be placed on credit hold?

Observations:

- Looking into various credit hold and release scenarios, it is easy to see that there is much more that can be done.

- Even the two most common credit hold scenarios, customer exceeds credit limit and the customer has a past due invoice, are simultaneously employed by only 45 percent of the participants

- When we add orders pending to the two aforementioned scenarios, only 35 percent use all three parameters

- Only 40 percent use any sort of combination of a credit limit parameter, past due parameter, and pending order amounts

- Here are the responses captured by the “Other” category:

- A customer has not had credit information reviewed over the last 12 months

- A customer has been inactive for a period of time (E.g., 90 days or 12 months)

- Orders are held pending credit card information or advance payment

- Orders are held when default terms are changed

- Orders are held pending receipt of sales tax exemption certificates

- If the requested ship date is greater than the due date of a future order

- Owner’s and credit manager’s discretion

- Past due greater than $10,000

- Conclusion: most company’s credit hold mechanisms do not cover all contingencies

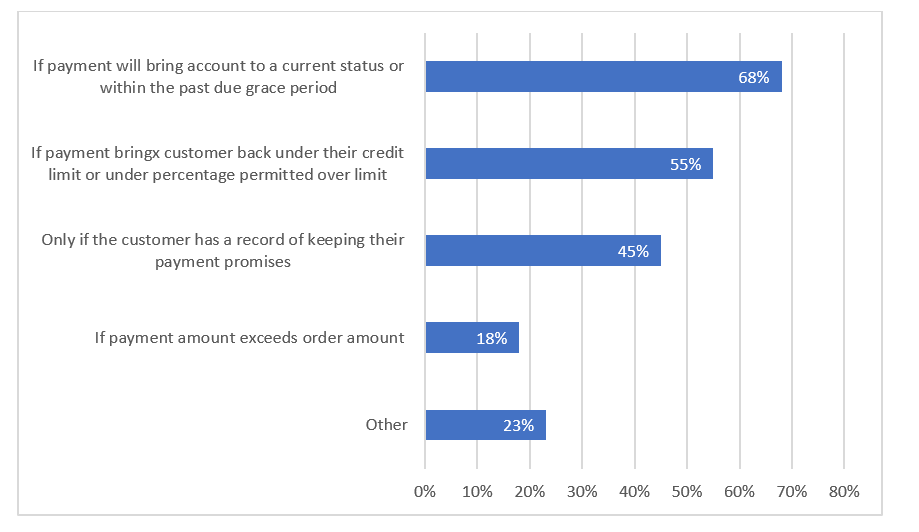

Can a held order be released by any authorized credit staff member when there is a promised payment?

Observations:

- When a payment has been made, common practice is to allow any authorized credit staff member to approve lifting any credit hold

- Entries in the “Other” category”

- All orders on credit hold must be manually released

- If the order is under $10,000 – order GT $10,000 must be approved by the credit manager of the company President

- Owner’s and Credit manager’s decision

- Payment promises are not accepted, only receipt of funds

- Senior Credit Analysis can use their discretion within reason

- Case by Case

- Any authorized individual can release at their own discretion

- If there is no history of negative events

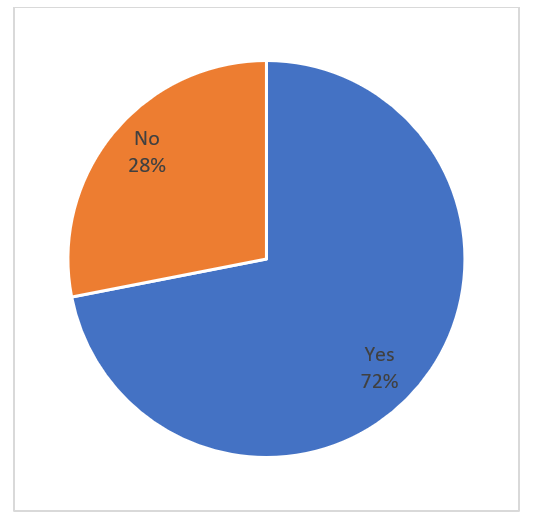

Is an automatic credit hold imposed on a customer upon receipt of evidence suggesting a business downturn threatening future payments, bankruptcy, or business closure?

Observations:

· Upon receipt of derogatory information on a customer, best practices call for an automatic credit hold at least until a thorough review is completed

· Even though a majority do this, over 1 in 4 still do not

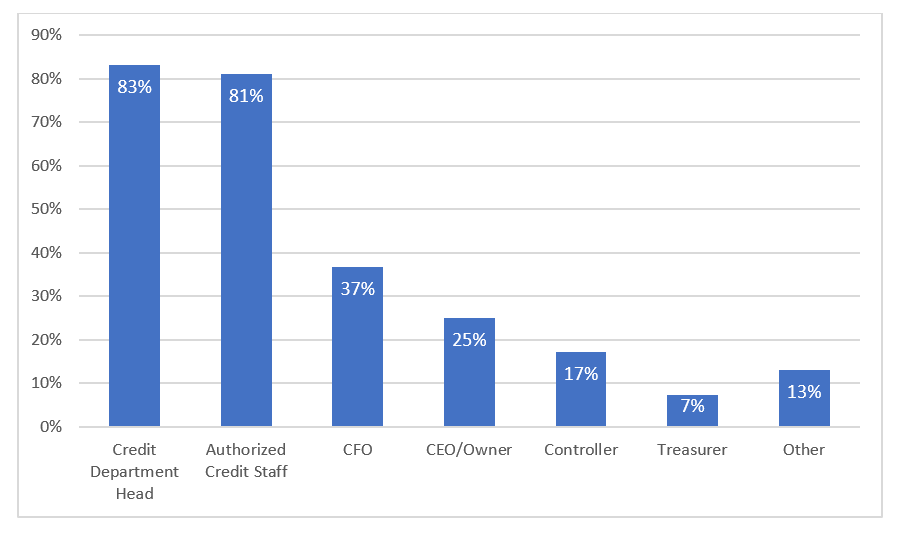

Who has the authority to release order from credit hold even though the standard release parameters have not been met?

Observations:

- When it comes to releasing credit holds, much is left up to the discretion of the credit manager and authorized staff members

- CFOs, CEOs/Owners, Controllers, and Treasurers appear, in many cases, to be detached from the credit approval process

- Answers to ‘Other’ included

- General Manager

- VP

- Various field management positions

- CFO and VP of Sales together

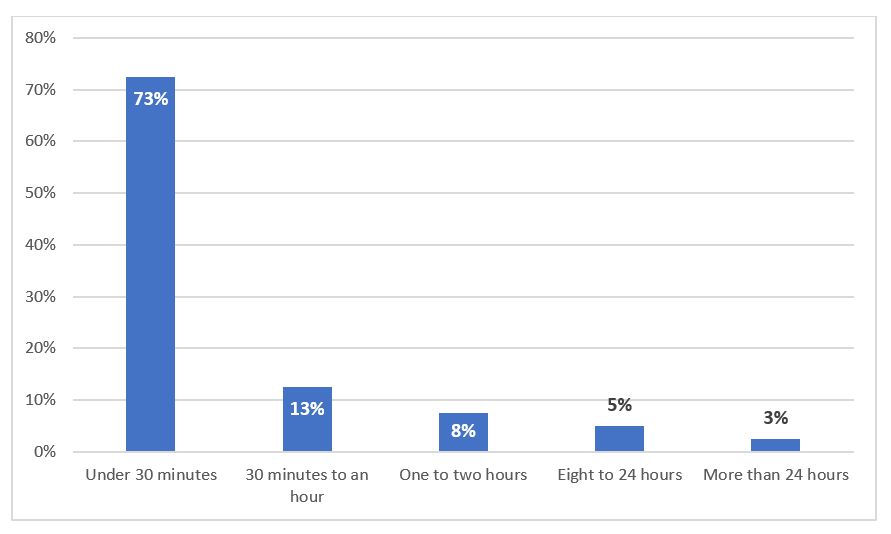

On average, how long does it take from the time payment is received to resolve the issue to releasing the credit hold?

Observations:

- The vast majority of credit holds are released without delay, which in most cases will facilitate same-day shipping

- Even so, 8 percent require a full workday or longer to clear a credit hold once amble payment is received

Please tell us what you like or don't like about your credit hold and order approval processes.

“We don't like the fact that when our system calculates open balances + order amounts, it can't separate between open invoices and open deductions, which are generally valid.” Kathy Brown, Funai Corporation Inc.

“We went on a new ERP system, on 6/27/22. Data needed to evaluate orders on hold requires the use of a calculator and pulling information from multiple screens. All of these actions take time.” Dave Zahller, CCE, Credit Manager, Tubular Steel, Inc.

“It's a manual process and the software doesn't have any allowances. It can be $1 over credit line or past due and the order automatically goes into "review." This means we review roughly 34% of all orders. If we know an account is on "hard" hold and payment gets posted, we manually take it off hold right away, otherwise a report is run periodically to see if any accounts on hard hold have made a recent payment, so we can remove the hard hold. We paid for a modification that causes the order to go into review if the default terms get overridden by order entry.” – Anonymous

“Our credit hold currently needs a lot of work. It is too black and white and does not allow for customization by a customer and is too broad so the majority of all sales orders go on hold.” – Anonymous

“I don't like that our system does not place an order on credit hold if the account is past due.” Michelle Wilson, Credit Manager, BEGA US Inc.

“The manual nature of some credit holds.” Keith Buggs, Senior Manager of Credit, Henry Schein

“It is very time-consuming to follow up on getting the payments in-house before the order ships. The ship date can change but the credit department is not notified of changes to ship dates.” Debra Layman, Credit Manager, Sauder Manufacturing Co.

“Includes back ordered product in pending orders.” Steven Duerwald, Regional Manager Credit, Sub-Zero Group Inc.

“What we enjoy and strive for is being creative and an extension of sales. We attempt to find a way to ship every order with a decent amount of confidence and or security and at times it takes a case-by-case plan.” Tim Murphy, Credit Manager, Ohio Valley Flooring

“One person contact, one person making the decisions, No leapfrogging to get others to get account taken off of credit hold.” Lupe Maki, Credit Manager, IFD

“With credit holds there's leverage on customer orders being released for shipment or future orders being processed.” Natalie Simmons, Credit Collection Specialist, GMM Pfaudler US Inc.

“We have a common-sense process with appropriate system checks and balances.” – Anonymous

“Credit holds may be impacted by aging credit balances. Our system takes into consideration debits and credits when determining a review of the order.” Brad Crossman, Director of Credit, Mercury Marine

“Works well for a company of our size.” – Anonymous

“Overall, the parameters in place allow us to review orders and make better business decisions. Holding based on delinquency or inactivity also allows for in-depth reviews of creditworthiness.” Carlos Anderson, Credit Manager, Kravet Inc.

“Our system recognizes the credit release even on backorders. So, if we release an order and there are back ordered items, when those become available, the system recognizes the release even if the account has since gone past due or over their limit.” Tawnya Marsh, Corporate Credit Manager, Pendleton Woolen Mills, Inc.

“Our system is very good- we have certain parameters that are set for holds, past due, payment method, PO# to follow, and inactive accounts. the holds are based on certain codes that other departments have to put into the order, which is a negative sometimes.” Kim Newbury,

Director of Credit, Antigua Group, Inc.

Observations:

- Simple credit hold mechanisms can still involve a substantial amount of manual work that could be eliminated with better routines

- Those with more sophisticated systems that account for credit and debits, new orders and backorders, as well as a host of other nuances that may not apply to every company, appear to be well received by their user.

- An efficient credit hold and release mechanism helps eliminate customer issues.