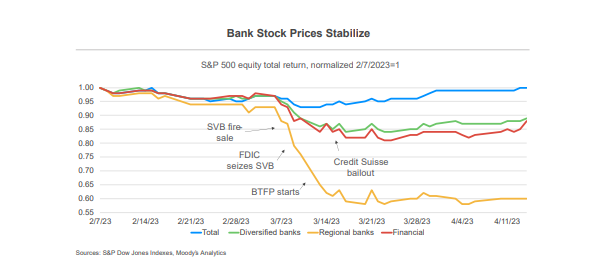

The government’s rapid intervention appears, at least for now as the following chart indicates, to have stabilized the banking sector. Three weeks after the run on Silicon Valley Bank, the industry stabilized, and more recently deposits have begun returning to small and mid-sized Banks.

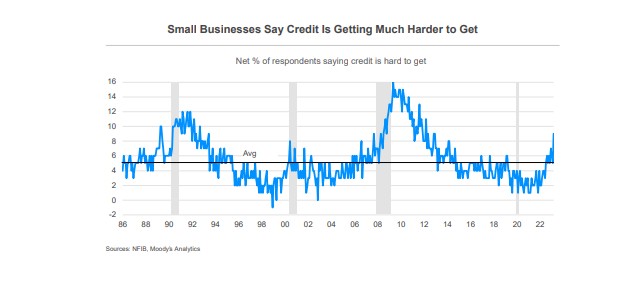

The lingering problem is that banks are now very much risk-averse, and that is showing up in the small business lending marketplace. According to a March 2023 survey by the National Federation of Independent Businesses, banks have become more reticent to lend to small businesses. As the following chart illustrates, the percentage of small businesses finding it difficult to get bank credit this year is at its highest level since the 2008-2012 liquidity crisis and rising.

When bank credit is dear, small businesses rely on their suppliers to augment working capital, often by requesting extended terms or simply paying slower. Trade credit executives beware.