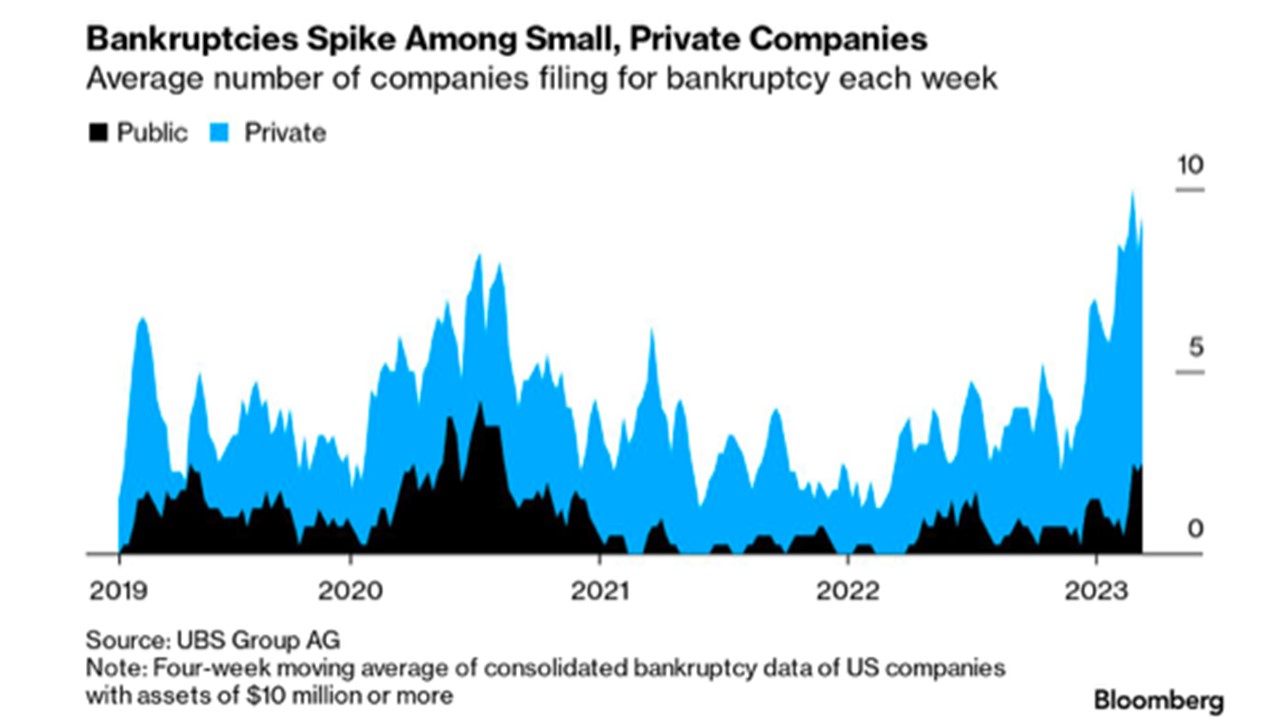

After reaching unprecedented lows once the initial shock of the Covid Pandemic passed, and continuing into early 2022, commercial bankruptcies of both public and private companies have been rising for almost a year now. In terms of private firms, in recent months those increases have turned into a spike.

This comes as no surprise to the editors at Credit Today. We’ve previously noted that after the surge of small business failures when the Covid shutdowns went into effect, the economy created over 5 million new businesses in 2021 alone, while many other businesses remained on life support thanks to government stimulus funds. US Census data shows that for decades, new businesses tend to fail at roughly 20 percent per year – only 50% make it to their 5-year anniversary. We went over a year with very few new businesses, so it is no surprise that the law of averages is catching up. Factor in high inflation and rising interest rates, and there is every reason to expect commercial business failures to continue rising. Keeping the Great Recession of 2008-2009 in mind, what we are seeing now may just be the tip of the iceberg. Credit Managers beware.