SnapShot Survey: 2023 Training Environment

Training and professional development have become more important than ever, especially in credit departments. On the one hand, you have a dynamic work environment undergoing seismic changes that range from the work-from-home/back-to-the-office debate to rapid advances in personal technology to digital transformation. At the same time, the boomer generation is retiring, causing a great deal of turnover in the credit profession in terms of newcomers and new leaders. With this context in mind, this survey looks at the current training environment from the perspective of credit executives.

Observations:

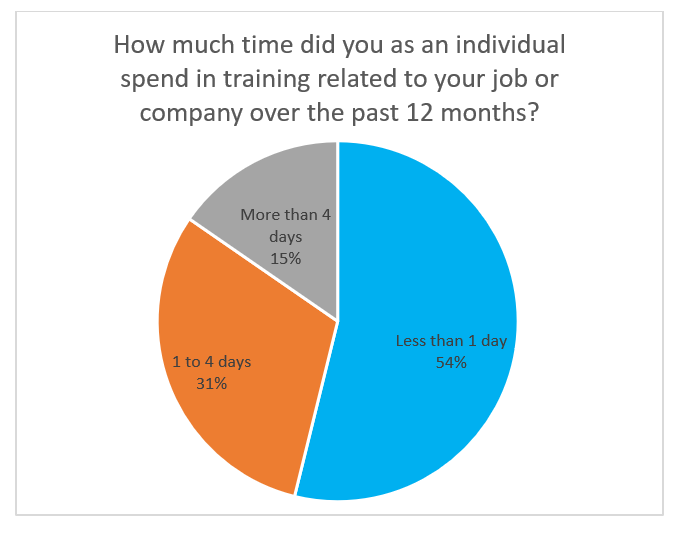

- Most credit organizations provide very little training over the course of a year

- Average: 19.2 hours/year

- Median: 4 hours/year

- Range: 0 – 100

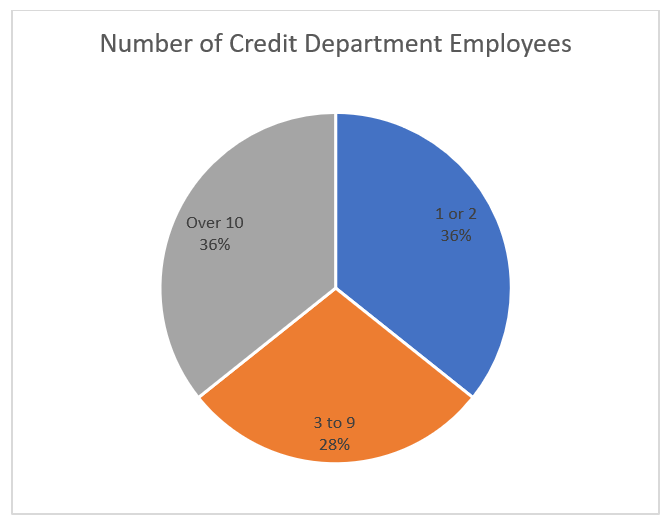

- Indications are that larger organizations tend to provide more training

- The average for organizations with 3 or more employees increased to 23.5 hours of training per year, while the median rose to 15 hours

- Credit executives in a small credit department are well advised to look after their own training

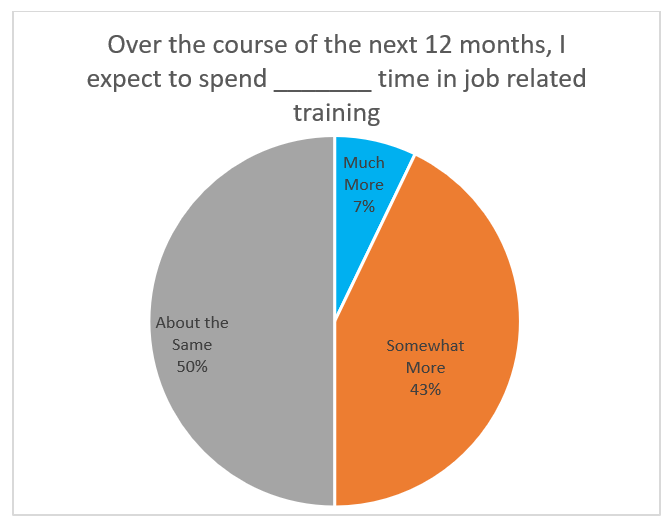

Observations:

- There is a clear bias towards more training

- This was equally distributed among those working in both smaller and larger credit departments

Observations:

- Five areas stood out from among the others:

- Portfolio Monitoring and Analysis was the skill in the most demand. Other surveys and research have shown this to be an area where credit executives could do better

- Training Financial Statement Analysis, Credit Scoring, and Risk Mitigation Instruments as key training areas were cited by over a third of all respondents – interestingly, they are all related to risk management

Legal Issues also stood out, which is not surprising since this is always a dynamic area of knowledge and expertise that requires constant updating

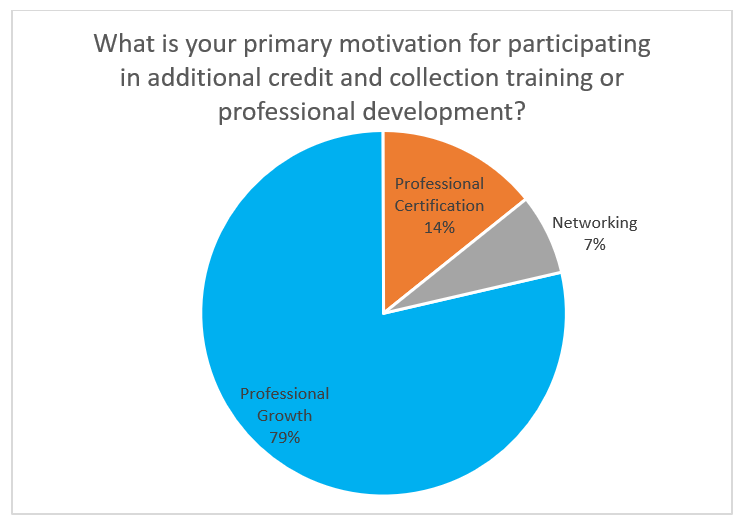

Observations:

- Professional growth is the overwhelming reason credit executives seek additional training

- In the past, there was more interest in improving job performance, but whether the goal is professional growth, certifications, or networking the key beneficiary is the credit executive, and helping the company is a secondary factor

Question: What training would have improved your preparation as a credit and collections professional? What is needed to complete your training? Please feel free to discuss training topics as well as formats.

“Legal Aspects of Credit, Data Analysis, Risk Identification Mechanisms, Risk Management Framework, Risk Management Leadership.” – Julia Phinithi, Head: Credit Risk Strategy Management, Sechabasedi

“Looking beyond credit & collection piece to sales relationships, margin, product management, etc.” – Milton Barnes, Revenue Assurance Manager, Sun Chemical Corporation

“A.I. training to gain more knowledge on how we as a company can keep pace and better utilize new technology to assist with collections and gathering information.” – Carlos Anderson, Credit Manager, Kravet Inc.

Survey Demographics

Participants: 14