SnapShot Survey: Collection Practices

When collection automation hit the marketplace, roughly 30 years ago, it began changing the way people approached collections. Before then, there were no collection strategies or courtesy reminders. There was no process in place for when collection activities were to be initiated. As you can see from the results of this survey (there were 21 participants), those activities are now common collection practices, whether or not collection automation is being used.

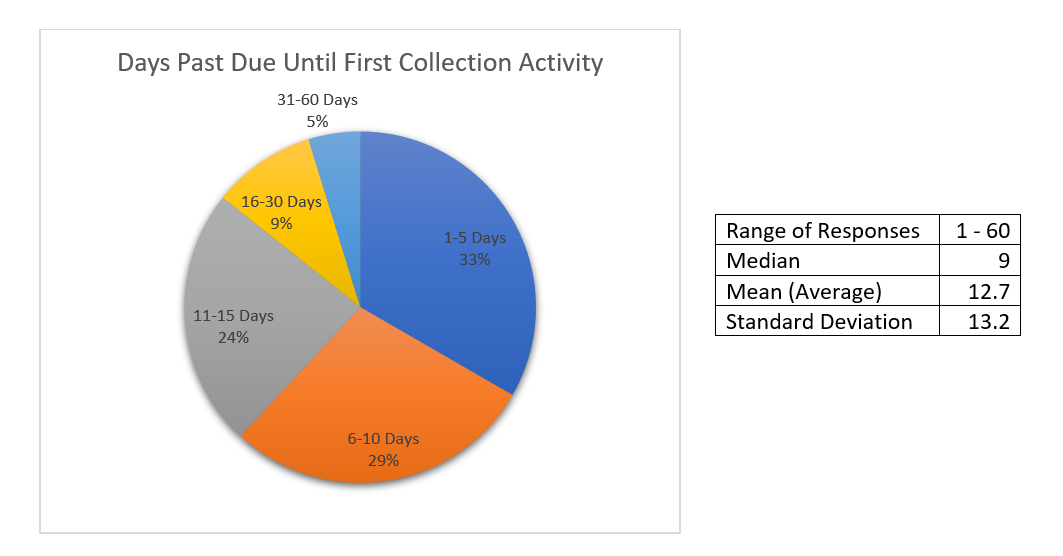

Question: Assuming your customer's account is otherwise current after an invoice goes past due, how many days does it take before your organization initiates collection activities (make your first collection call or send a reminder notice)?

Observations:

- 86 percent begin collections within 15 days of an invoice going past due

- There was a considerable difference between those with manual vs. automated systems

- For those with manual systems, the average first contact is at 14.7 days past due (median of 14 days)

- For those with at least some automation, the average first contact drops to 7.5 days past due (median of 8 days)

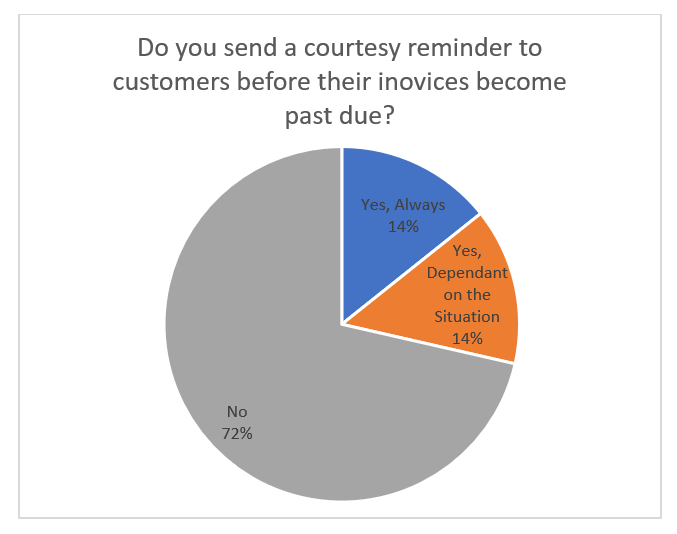

Observations:

- The organizations that always send a courtesy reminder have a fully automated collection process

- The organizations that only send courtesy notices when certain criteria are met are primarily manual

- The criteria for sending courtesy notices that were given are:

- History of paying late

- Large amounts due

- Done by an outsourcing partner

- 20 percent of the organizations that do not send courtesy reminders have partially automated collections – the remaining 80 percent are primarily manual

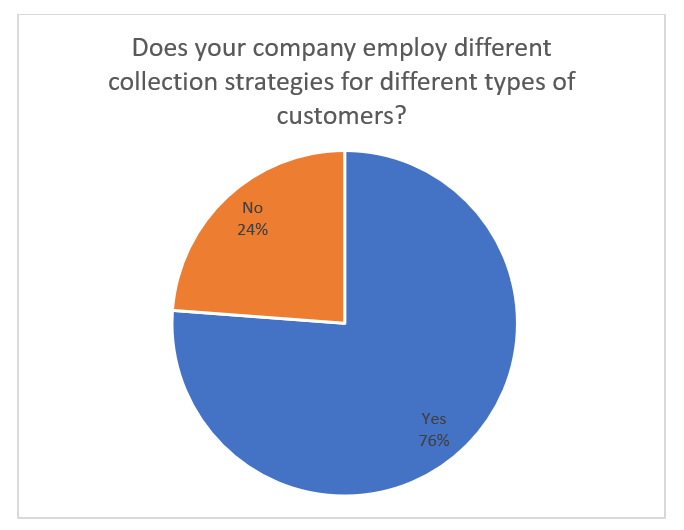

Observations:

- Very surprisingly, 60 percent of those that don’t have collections strategies have to some extent automated collections

- 87 percent of with primarily manual collection processes have deployed collection strategies

Observations:

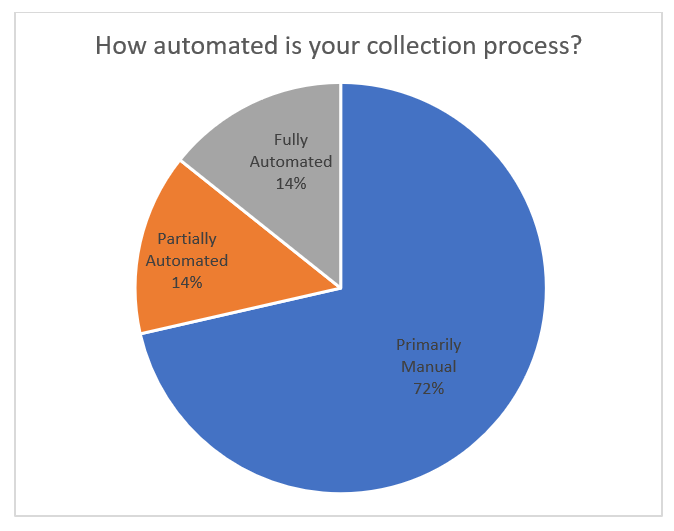

- Even though collection automation has been around for 30 years, barely more than one out of four organizations have adopted it in some form

Question: Please tell us about your collection process. How structured is it? What could be improved to help you collect more, faster? What are your greatest collection challenges?

“Manual Process Collection process being implemented through collections worklist in the system with the ability to add notes, reminders, automated triggers for sending reminders, etc.” - Henriette Krunic, Credit, Engen Petroleum Ltd

“Most of our collection process is automated and our collectors have automated task lists but it would be a great help to get alerts on past due invoices and if we could write the rules for those alerts. Also, our payments are posted to our AR software a day late -- it would be helpful if our payments could be posted in real-time and a notice sent to our collector of payment received.” - Debra Layman, Credit Manager, Sauder Manufacturing Co.

“We have a scheduled workflow that escalates in the type of action, starting with an automated, courtesy statement 7 days before the due date and ending with legal/3rd party intervention if the customer is unresponsive and/or doesn't work with us to resolve the past due.” - Derek Sachs, VP Treasury, America II Electronics

“Current collection process is manual. For customers without a portal, we email them when an invoice is past due. For portal customers, we download the data and follow up as needed or provide additional information if necessary.” - Kate Delaney, Credit Manager, Sterilite Corporation

“Our collection process is very manual. We email and make collection calls daily. The challenges are communication with an AP person. So many AP employees work from home now and then there is a large turnover rate with these positions. We leave lots of voicemail messages and then follow up with emails and oftentimes contact the sales rep to get involved in collecting balances owed. Another challenge is keeping skilled employees & hiring for our own company.” - Cindy Jacobs, Credit Manager, Quorum International

“Terms are net 30. We send statements & invoices monthly on the 1st for the recently completed month via email. We follow this up on the 7th of the month with a reminder to customers for newly past due balances (came due 30th of the prior month). After this it manually calls and emails to collect the balances owed.” - Tom Mazzarese, VP of Treasury & Credit, CCA Global Partners

“Monthly statements are run. Any customer that missed the discount date is sent a reminder. When the invoice is past due, a letter is sent along with the past due invoice. A tickler is put in place to call after one week if no response. The greatest challenge is customers that do not respond back to either.” - anonymous

“Each collector has a group of accounts they're responsible for. We assign accounts a risk score based on their past performance with us. Collectors typically know which accounts they have to chase vs those that pay within a reasonable range. They have the ability to run/edit quick aging of their accounts to "watch" +/or chase earlier. They must run/review their whole aging periodically throughout the month and will email copies of overlooked invoices. The old program isn't automated. We've been doing this a long time and it's way easier to "keep" the aging clean than trying to clean it up after neglect.” - anonymous

“We are a subcontractor in the construction of very large projects. Normally it takes some 30+ days to pay our subs and suppliers and gather all of the necessary waivers to submit to the general contractor before we are in line to get funded from the owner or lender. This is why we do not start calling until the invoices are 45 days old (15 days past due).” - David Osburn, Director of Billing & Collections, ACCO Engineered Systems, Inc.

“It was structured. Moving outside the country [via outsourcing] it has broken down. We are moving to software to try to get the structure back.” - anonymous

“Fully manual, quite capricious. Have to look at the history of account payments, whether the customer is a Friend of the Owner, how automated/sophisticated the customer's system is (e.g., can the customer receive an email, or do they have a computer?), size of the balance, etc. I try to send an email first if possible when the oldest invoice ages 15 days beyond terms, then follow up by phone in a week if possible. Two challenges come to mind presently -- being asked to wear too many hats within the company (like all my co-workers), and not having enough methods to reach out to customers (working on finding a good texting option with no budget to spend and no company mobile phone).” -- Aaron Howard, Office Manager, T. H. Kinsella, Inc.

======

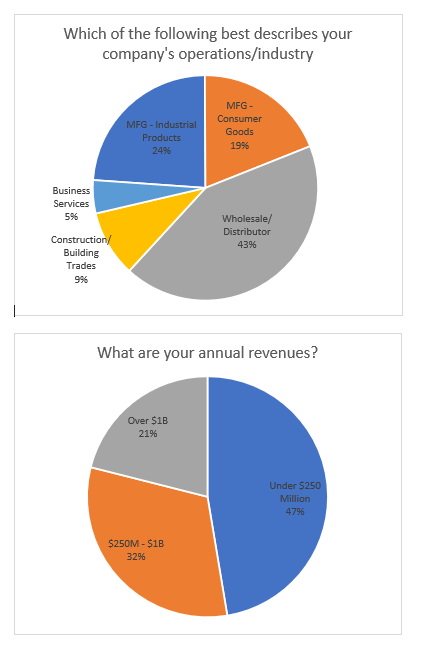

Survey Demographics

Number of responses: 21