SnapShot Survey: Key Financial Performance Indicators (KPIs)

By David Schmidt

“You can’t manage what you don’t measure.” That’s pretty much the entire premise behind KPIs. The key behind a good KPI and the performance goals you set is that they are both transparent and relevant. In other words, they are easily understood and they drive behavior in the ways you want. You don’t want to realize any unintended consequences from focusing on improving a specific KPI.

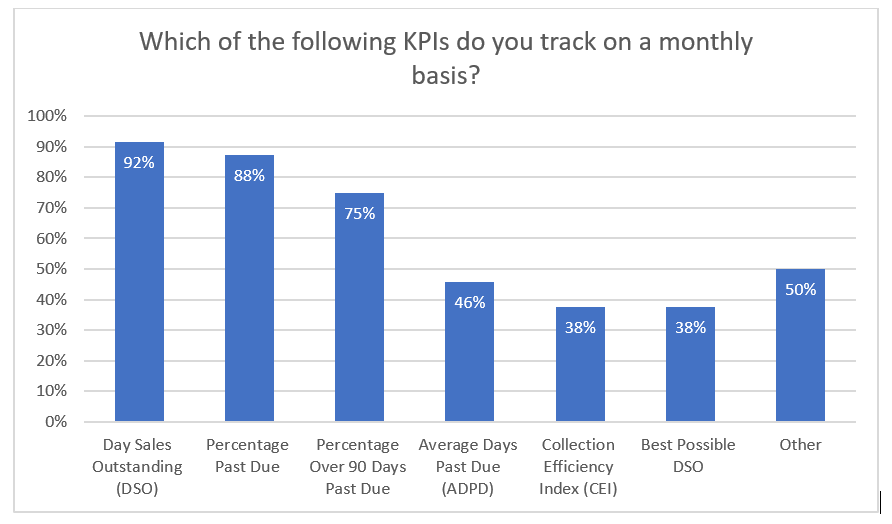

In terms of accounts receivable (AR) performance, there is a lot that can be tracked, as the first question of this survey reveals. However, in terms of the metrics that most organizations see as important, only a few stand out. Of course, how those KPIs are shared is also important and this survey delves into that as well, giving you a good point of comparison in terms of your own performance tracking.

Observations:

- There were just three measures tracked by a majority of credit organizations: DSO, percent Past Due and percent over 90 Days Past Due

- Other KPIs include: Bad Debt, Bad Debt as a percent of Sales, Cash Collected, Chargeback percent to AR, Chargebacks cleared in month, Collection Ratio, Credit Blocks, Days Beyond Terms – weighted, Over 120 Inventory, Receivables vs Inventory, Turnover, Unapplied Payments, Weighted Credit Period (WCP), Over 30 AR, Working Capital, Working Capital turnover days

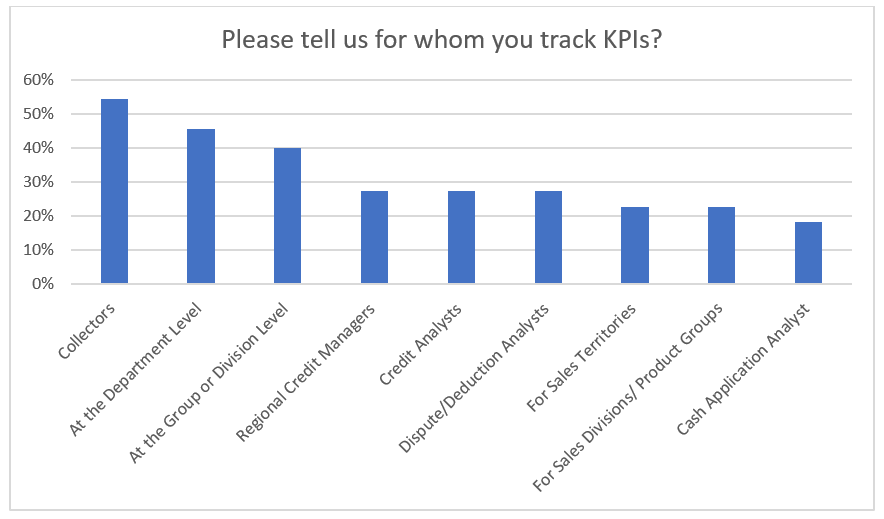

Observations:

- It is assumed that KPIs are being tracked at a company level

- Once you dip under the corporate umbrella, however, there is a wide disparity in regard to the individuals or groups being measured

- Only collector performance indicators were tracked by a majority

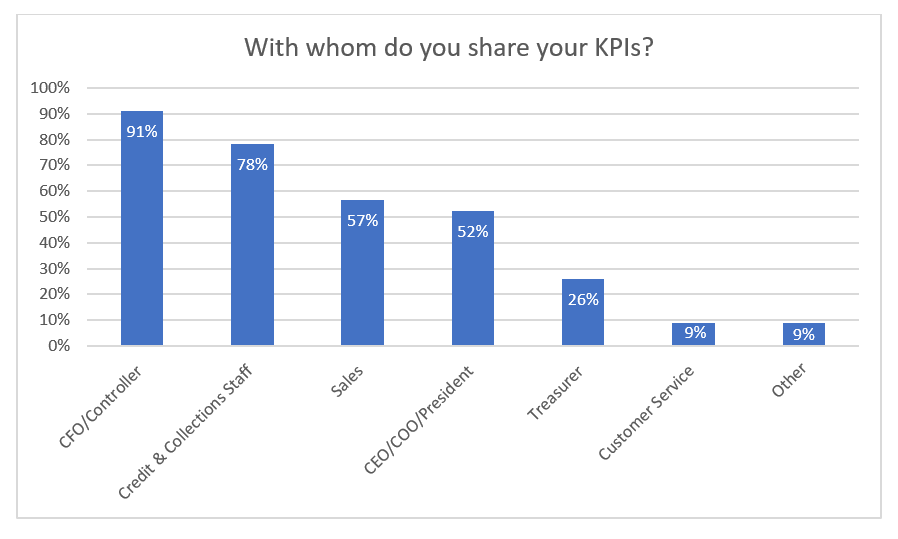

Observations:

- While over 1 out of 5 do not share credit department KPIs with their staff, that may be because they are a single-person department

- Similarly, only 26 percent provide KPIs to their Treasurer, but that could be due to the treasury role being handled by the CFO/Controller

- Other included an NACM Credit Group and an International Finance Team

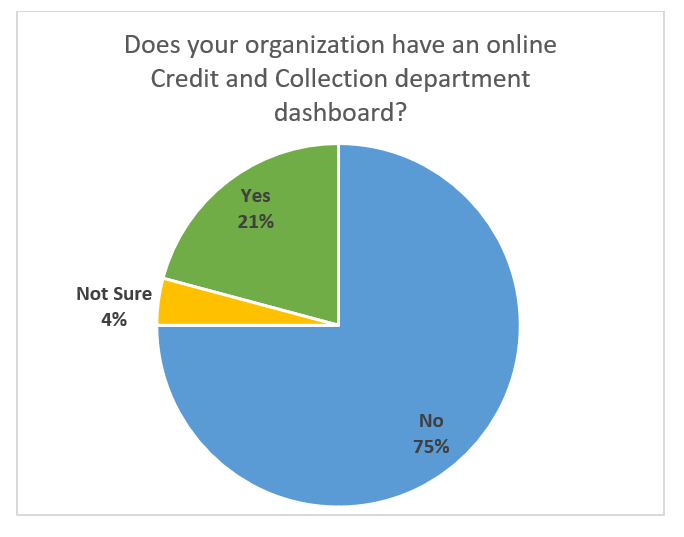

Observations:

- At least 3 out of 4 credit organizations report not having a dashboard

- The advantage dashboards provide is that they provide real-time insights into AR performance for credit department management, staff, and upper management, thereby eliminating manual reporting efforts, and the time lag inherent in manual reporting

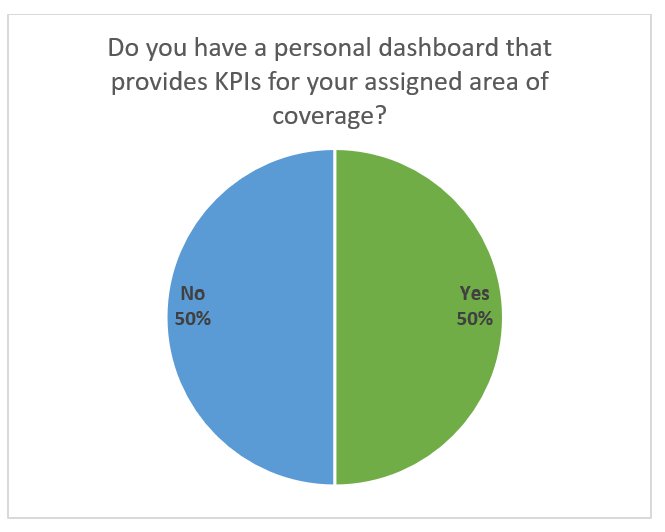

Observations:

- Individual users of Credit and Collections software typically are typically provided a dashboard they can personalize

- A few ERP systems may also provide dashboard capabilities

|

How many days does it take to generate the report that summarizes AR performance at month’s end? |

|

|

Range |

>1 to 10 |

|

Average (Mean) |

1.6 |

|

Median |

1 |

Observations:

- Two out of three respondents only require a single day or less to generate their monthly AR report

- 96 percent generate the report within 4 days of the month’s end

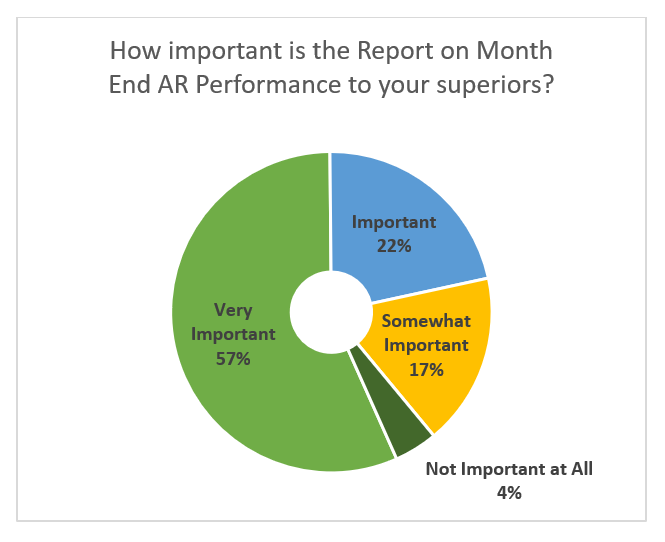

Observations:

- Nearly 4 out of 5 responded that upper management regards the monthly report on AR performance as important or very important

- Upper management interest in AR performance tends to increase in the face of economic uncertainty

Please tell us about your month-end reporting on AR performance. What are the challenges you face? Are you doing anything innovative?

- “We manage AR out of multiple ERPs. We also limit our reporting to DSO, however, we are in-process for developing BPDSO, ADD and CEI. Part of our M/E reporting includes a list & review of accounts aging with analyst comments plus a list of accounts overline and analyst feedback.” -- Brad Crossman, Director Credit, Mercury Marine

- “One of the challenges is properly identifying items that are past due versus items that are open pending returns or credit needed. The overall reporting takes into account all of the major delinquency metrics such as DSO, percent past due by account, collector, and overall.” -- Carlos Anderson, Credit Manager, Kravet Inc.

- “They want bad debt measured against the warehouse it shipped from. Problem is multi-line

invoices have products from more than one warehouse.” -- Dave Zahller, CCE, Credit Manager, Tubular Steel, Inc.

- “Gap reporting - AR balance vs. credit limit vs. insurance” -- Milt Barnes, Revenue Assurance Manager, Sun Chemical Corp

- “Problem is cash is not posted immediately so we had to adjust the month-end AR for cash we've seen hit the bank but not yet posted.” -- Chris Finch, Retired

- “Excel spreadsheets and summary docs.” -- David Bernardino, Director of Credit, McNichols Company

- “Month end AR performance is used to help decide how we evaluate new credit applications and how we pursue collection activities the following month.” -- Rob Richardson, Director of Credit, Corken Steel Products

- “We use WorkFlow AR for our daily and month-end metrics. The dashboard gives our Controller daily visibility of our top past-due customers and an easy review of the collection notes to view if there are any problems. As Credit Manager, I can see on a daily basis how and why invoices are aging out and can address those before they become a problem.” -- Debra Layman, Credit Manager, Sauder Manufacturing Co.

- “There is a lot of manual work involved. We would like to automate these reports and we are trying to build a database with historical data in PowerBI and then connect it to the live data in order to get automated dashboards. HighRadius also has some cloud-based platforms that we are evaluating in terms of integrability and feasibility.” -- Disha Sawlani, Credit Risk Management Supervisor, Acer Europe SA

Report Demographics

Participants = 24