SnapShot Survey: Key Process Performance Indicators

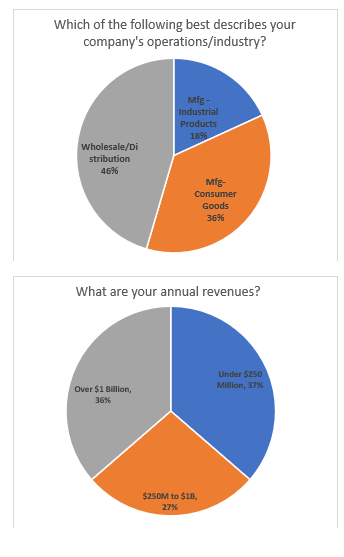

We recently conducted a survey focused on the Financial KPIs tracked by credit departments (you can view the findings here). This new survey, which focuses on Order-to-Cash (O2C) and Collection Process KPIs, continues Credit Today's benchmarking of credit department performance measurement. While there were only a dozen participants, they reflect a balanced cross-section of industries and company size and provide a good point of comparison with the Financial KPI survey.

As automation has moved into the AR domain, it has become easier to track more components of the O2C and collection processes. While the traditional financial KPIs have focused on outputs, process KPIs are better able to analyze inputs – in other words, how much effort is being put into the process, and what is the quality of those efforts, rather than just the final results. This provides for actionable insights that facilitate better management of the AR, and, when the metrics are available on an ongoing basis, be used to better affect month-end results.

Findings

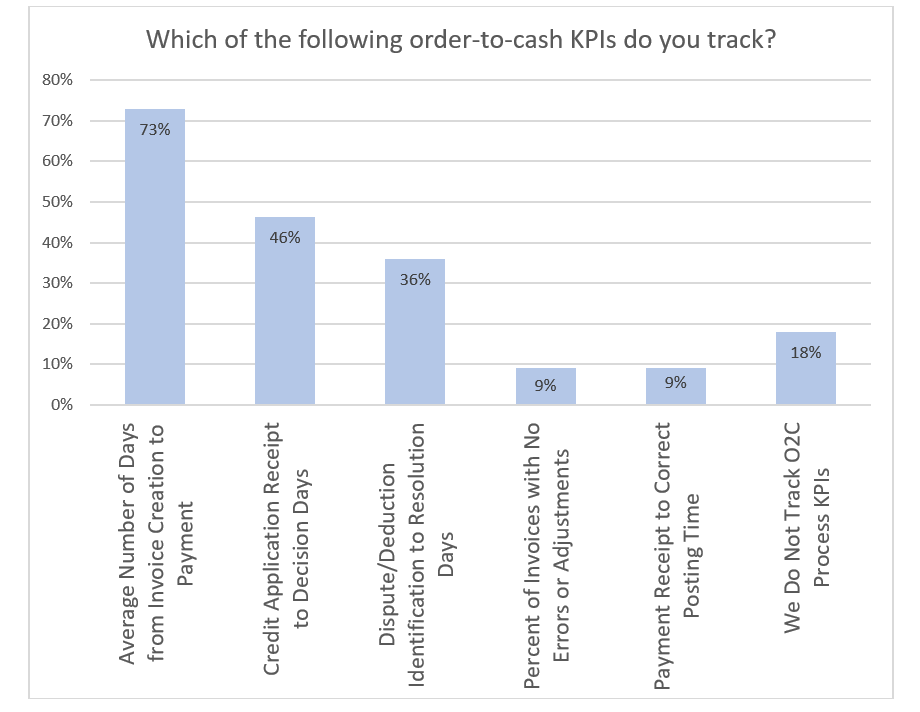

Observations:

- Nearly 1 out of 5 participating organizations do not track any O2C process KPIs

- Only 9 percent track invoice accuracy despite the fact that there is a high correlation between invoice accuracy and payment receipt

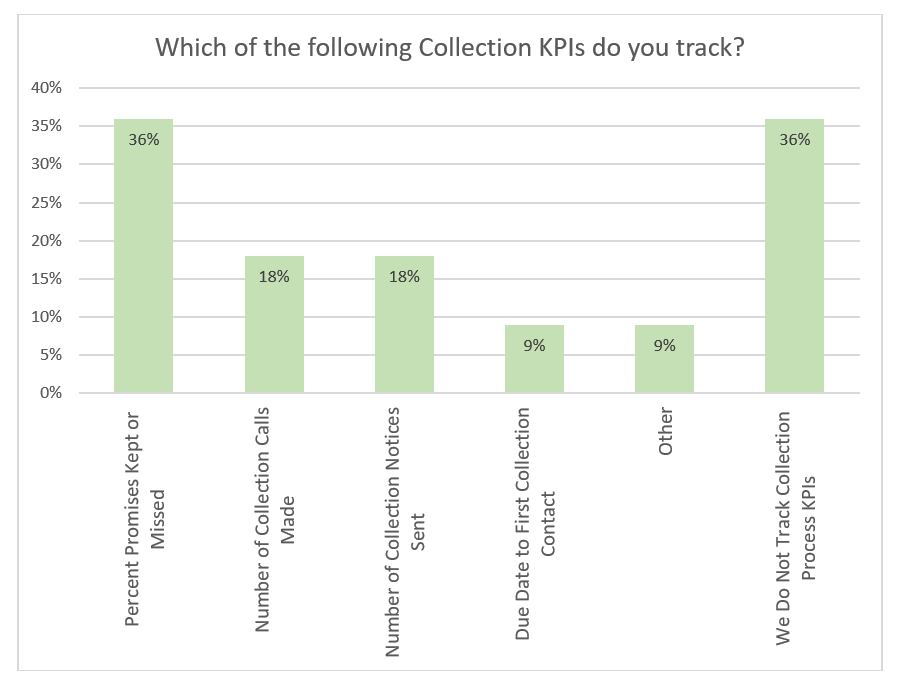

Observations:

- Over 1 out of 3 of the participating organizations did not track any collection process KPIs

- Only 18 percent track the number of collection calls and collection notices being generated

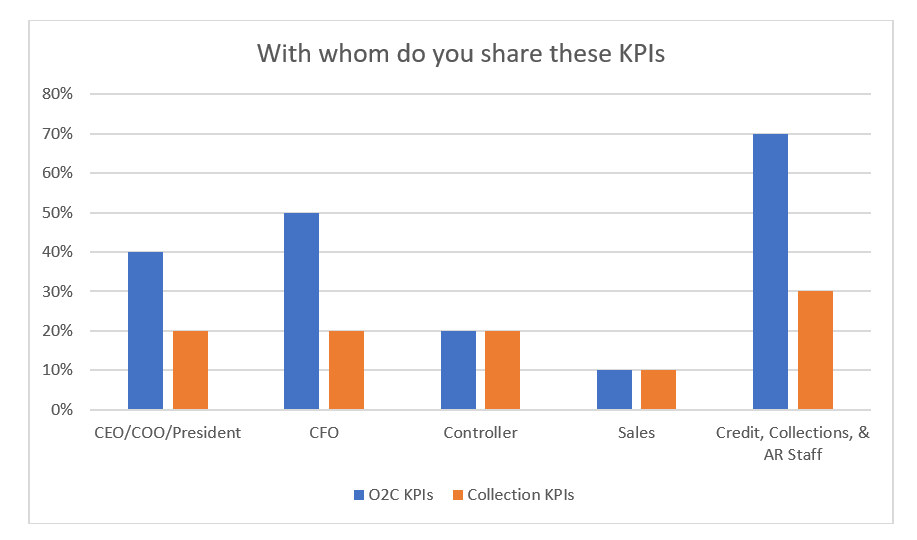

Observations:

- O2C and Collection Process KPIs are shared more within the credit department than with other company functions – this may be because these metrics are more focused on individual and department performance rather than company performance

- In our previous survey regarding financial KPIs that are tracked by credit, 91% of CFOs were provided the metrics along with 57% of Sales and 52% of CEO/COO/Presidents

Question: Please tell us more about your tracking of O2C and Collection Process KPIs. Which process KPIs do you find especially informative? Is there anything hindering your collection of process KPI's such as system limitations or lack of time? What additionally would you like to do in this area?

- “We are beginning the process of tracking O2C and Collection process KPIs, operating in multiple ERPs which has made the process a bit more challenging. Additional factors we will be exploring is generating systematic worklists, push reporting on the number of calls by analyst and automated 1st notification reminders to customers.” – Brad Crossman, Director of Credit, Brunswick/Mercury Marine

- “The O2C KPIs are recorded monthly but, not reported across the constituency unless things begin to track into negative territory.” – Barry W. Hickman, Sr Director of Credit, Dal-Tile Corporation

- “We would love to track more collection KPI's, but our system doesn't allow for this.” – Tracey Skipp, Corporate Credit Manager, Magnussen Home Furnishings

Survey Demographics