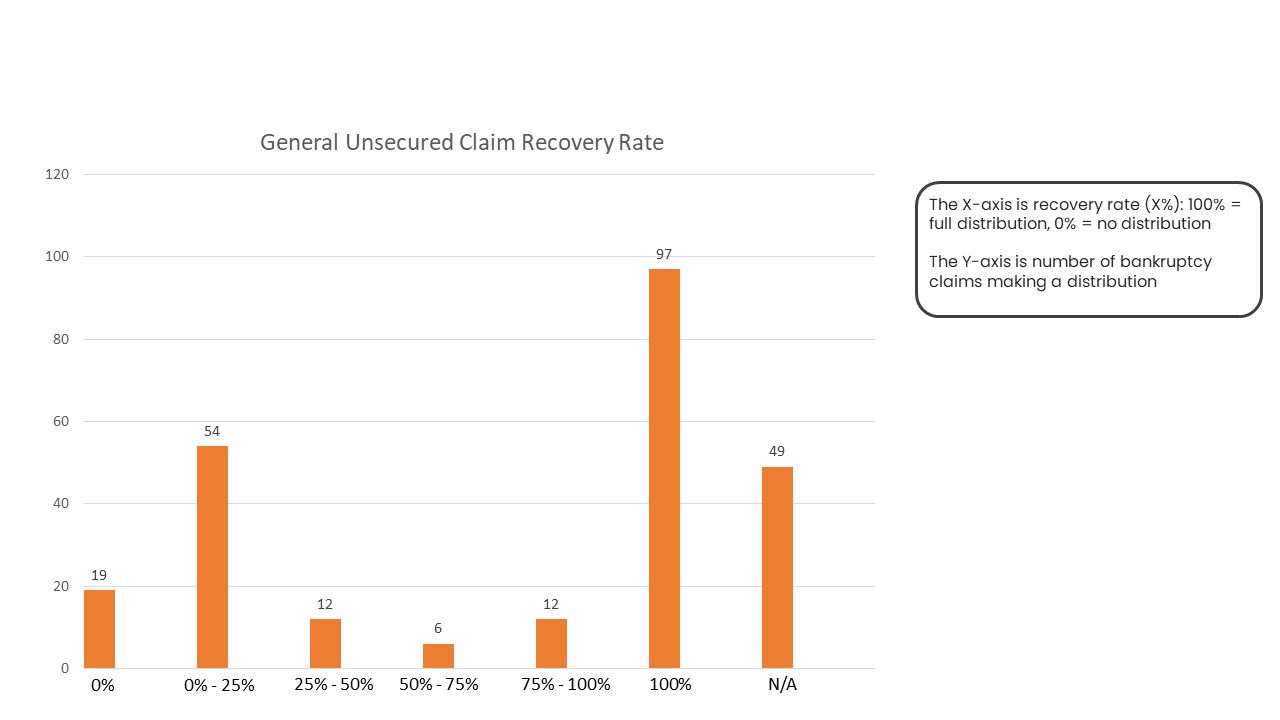

As the accompanying chart illustrates, getting paid as an unsecured creditor through a bankruptcy reorganization plan is very much an all-or-almost-nothing proposition. To retain supplier goodwill, many bankrupt debtors will create a reorganization plan that pays unsecured creditors 100% of their claims, but roughly one-third of the time other factors get in the way of doing that.

● The average recovery rate for general unsecured claims (GUC) was around 60 percent

● The median was 90 percent

● Roughly two-thirds of GUC classes received cash as the only recovery consideration

● About 10 percent of the GUC claim holders received trust interests as recovery.

● The remainder received a combination of liquidating trust interests and cash as their

recovery or combinations of cash, debt, equity, and CVRs (Contingent Value Rights).

Three cases that filed multiple plans were among the 102 cases with confirmed Chapter 11 plans that Bankruptcy Data (a part of New Generation Research) tracked in FY22. There was an approximately equal distribution of proposals for restructuring and liquidation, of which 30% included a Restructuring Assistance Agreement. There were just fourteen pre-packaged or pre-arranged plans.