Financial Statement Analysis for Commercial Credit Teams

For anyone who’s interested in getting into credit teams as an analyst, Financial Statement Analysis is probably the most important skill to have. This is reflected in almost every job description. Examples from job postings include:

- Provide primary financial analysis, credit risk assessment, and credit limit recommendations for existing and new customers

- Administers the credit granting function on new and existing customer for an assigned portfolio of domestic and/or international accounts with an emphasis on obtaining financial statement and performing ratio analysis to achieve objectives and goals

- Knowledge of financial statement components and solid understanding of key risk drivers

What is financial statement analysis?

Financial statement analysis is the activity of evaluating a company’s financial statements including Balance Sheet, Income Statement and Cash Flow Statement.

Credit analysts typically analyze financials to understand the financial strength of the company. This is a key input to the overall decision of whether to do business with a company on credit terms.

Why is financial statement analysis Important for credit decisions?

Analyzing balance sheets, income statements and cash flow statements will help credit analysts get insights into past trends, strengths and weaknesses of past financial performance.

The credit analyst is then able to use these insights to understand the company’s ability to pay its obligations including debt or accounts payable in the future.

Depending on these insights, credit analysts recommend a certain risk class and credit limit.

What are the limitations/pitfalls of analyzing financial statements?

Financial statements are essentially historical documents and needn’t necessarily predict the future performance.

Since financial statements are periodical in nature, some recent changes in the company’s operating environment could adversely affect the company’s financial performance. Some examples include:

- Changes in Leadership: This could be a yellow flag as they could affect the viability of the company and the revenues

- Loss of major customers: It is not uncommon for companies to depend on a few major customers for the bulk of their revenues. Losing a couple of these big revenue drivers has a direct impact on financial performance

- Competition: Technology has caused disruption in multiple sectors and the industry boundaries are not as rigid these days. For example, OTT is suddenly a viable alternative to theatres and there’s definitely an impact on revenues lost by the theatre companies because of OTT.

- Natural or Man-Made disasters: Disasters such as a hurricane or earthquake or wildfires could adversely impact companies

It is always good to look at the overall landscape to take credit decisions rather than just analyzing financial statements.

To understand how to take a holistic view of a company, watch this course on how you can you Porter’s five forces model to evaluate credit worthiness of a company. In this course you will understand how to evaluate the threat of new entrants, bargaining power of suppliers, bargaining power of customers, internal competition and threat of substitute products.

How to analyze financial statements?

The first step is to understand how to understand or interpret the information that is there in the financial statements.

The two kinds of analysis are horizontal and vertical analysis. Horizontal analysis is more of a trend analysis done over time. Benchmarking this data against the company’s competitor will give valuable information on the financial health of the company.

Vertical analysis or common-size analysis shows each item on a financial statement as a percentage of a base within the statement. For example, you can see what is the cost of goods sold as a percentage of total sales. Comparing this with the industry data will give you valuable inputs on the financial strength of the company.

For more detailed understanding on what the components of balance sheet and income statements are and how you can interpret the information that is on there, please see this short course on interpreting Balance Sheet and Income Statements.

The next step is to start analyzing and benchmarking financial ratios. Liquidity ratios are among the best ratios to benchmark especially for trade creditors as the larger the liquidity, the more protection there is for credit that you offer to the company.

After Liquidity Ratios, it is important to benchmark Activity Ratios such as Inventory Turnover Ratio and Creditor days, both these give you a measure of the working capital of the company and their ability to pay their creditors.

Finally, Net Income Ratios are good for evaluating the return on sales and long-term investments of companies. As with Activity Ratios, these are also a good measure to understand the working capital position of the company. For a detailed understanding on how to use financial ratios for credit risk analysis, watch this course.

Financial statement analysis is just one input

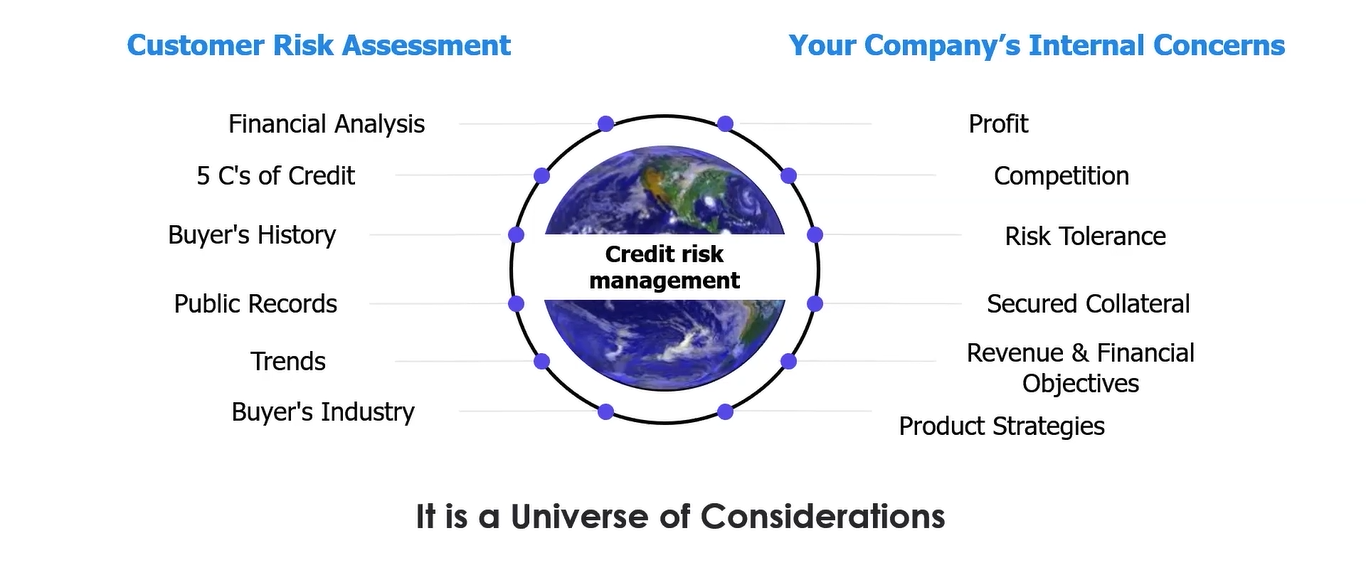

As we close out, financial statement analysis is just one input for the overall credit risk assessment process.

Just on the buyer side, you’ll have to assess the Payment history, public records such as bankruptcies and liens, the company’s growth history – growing, flat or declining, and finally the industry of the buyer.

On your company’s side, you’ll need to understand the profit goals, competitive pressures, risk tolerance, possibility of getting secured collateral and overall financial objectives.

That said, understanding and interpreting financial statements is an extremely useful skill as this is useful even outside the credit department, think M&A or venture capital.

In comments below, do share your stories of anything interesting that you had uncovered when you did financial statement analysis before.