Chart of The Week: Weighing the Economic Headwinds

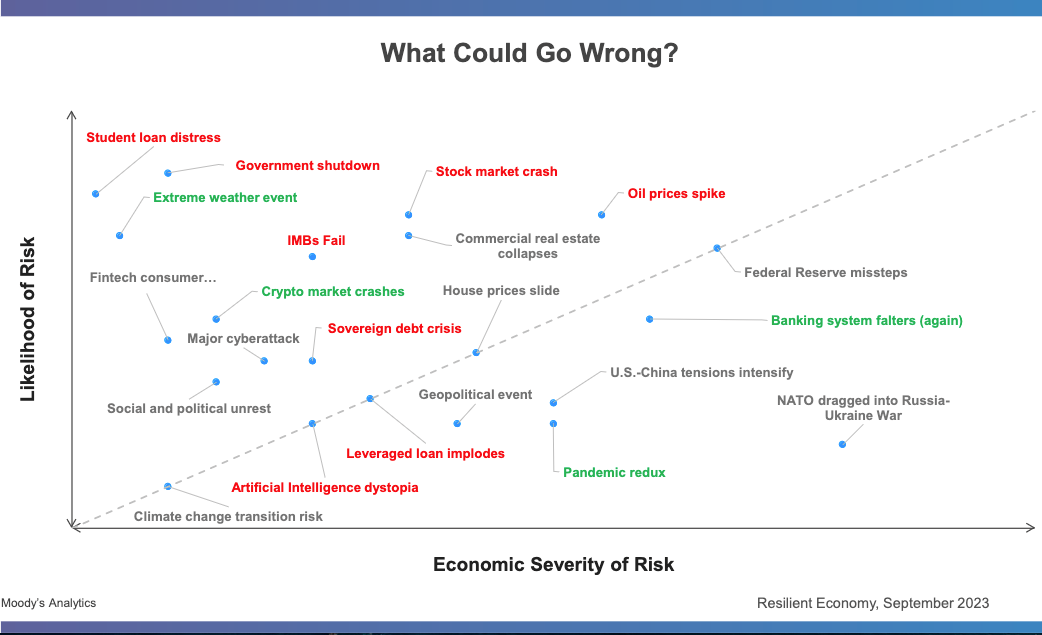

Any credit executive monitoring the news understands that various forces are shaping our future economy and the prospects for their industry and business. There is so much going on it’s hard to weigh the positive against the negative, and assign proportionality, especially with so many small threats to the economy. To address this issue, the folks at Moody’s Analytics built the following threat matrix.

The items in red are growing in significance, while those in green are becoming less significant, and those in gray are staying the same. To help maintain a balanced perspective on the economy, you might want to print out this chart and add factors specific to your company’s industry and marketplace as well as any new issues that come along.

Other Considerations

Already, there are factors changing the calculus of this matrix. For example, the attacks on Israel increase the likelihood of a spike in oil prices, among other things. The UAW strike is missing, though the impact should be negligible outside of the auto industry unless the strike drags on for over 60 to 90 days. And, the risk of a government shutdown was averted at the last minute, but the likelihood is increasing again with the overthrow of the Speaker of the House.

Another missing item is consumer spending. Low and mid-low income households don’t have much savings post-Covid. These are the most likely groups to spend any excess funds, so if there is wage stagnation, inflation, or rising unemployment, consumer spending is less likely to prop up the economy. In contrast, high-mid and high-income households tend to hold onto savings longer.