Credit markets are increasingly showing stress

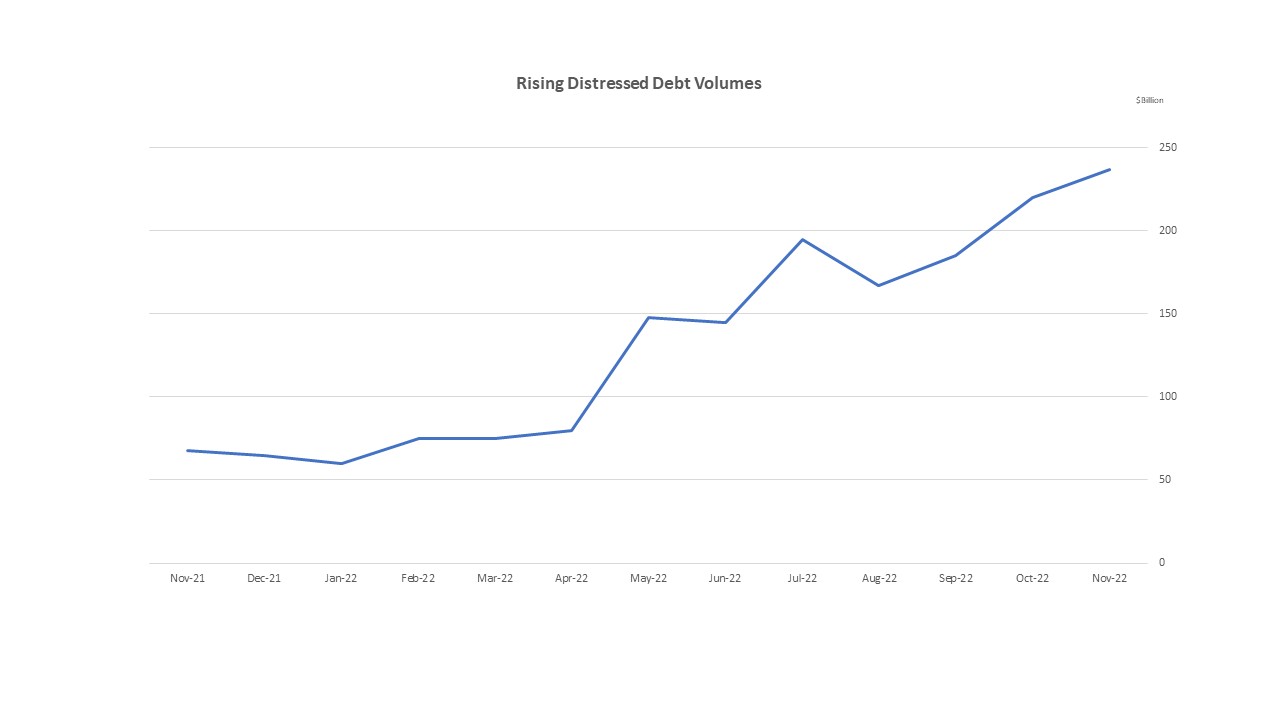

The pile of troubled debt in the US has more than quadrupled in the past year.

What Amount of Debt Do Your Customers Have?

Credit Cracks Widen With Ballooning Distressed Debt, a piece by Neill Callanan, Tasos Vossos, and Olivia Raimonde that was posted on the Bloomberg website on December 28, 2022, states that "Distressed debt in the US alone jumped more than 300% in 12 months, high-yield issuance is much more challenging in Europe, and leverage ratios have reached a record by some measures." The chart above and the one below make it clear why this is a volatile situation that credit executives should closely monitor with the FED continuing to raise interest rates and uncertainty in the banking sector.

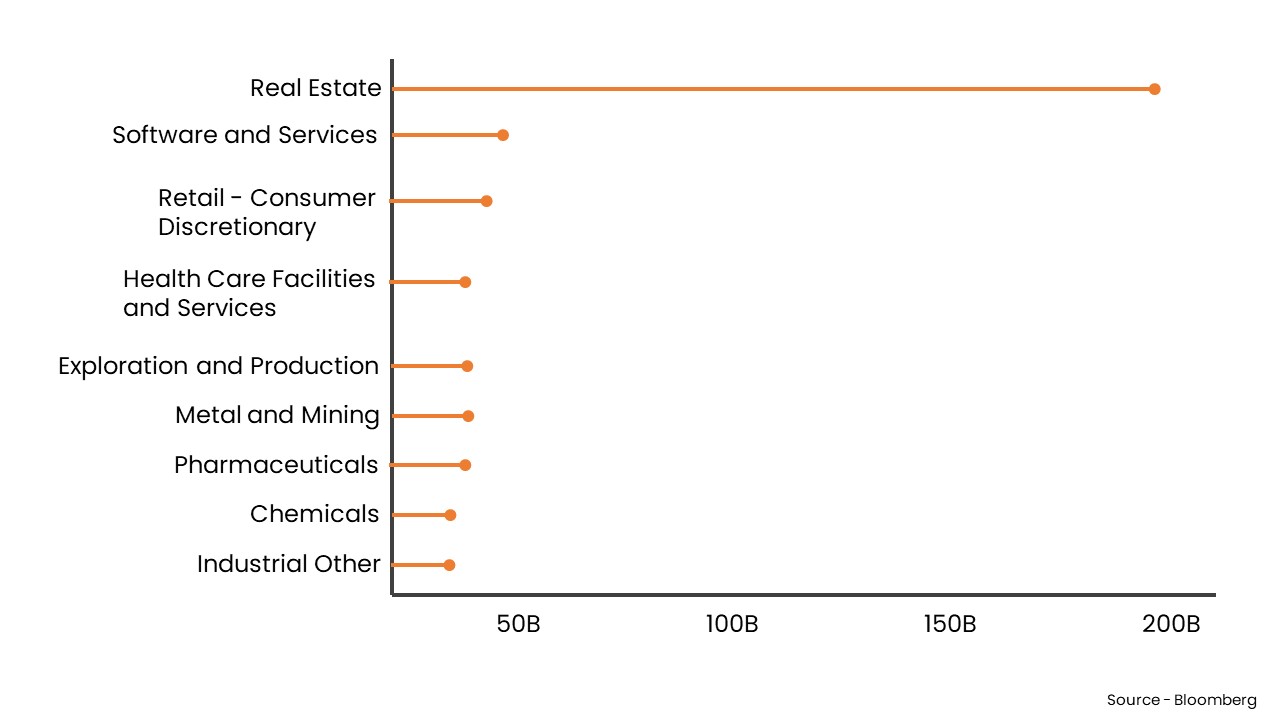

There are Already Elevated Signs of Distress

Commercial real estate is still coping with the after-shocks of the Covid pandemic, and the tech sector is even on more tenuous grounds in the aftermath of the Silicon Valley Bank and Signature Bank failures. And, when the pharmaceutical and chemical industries begin showing stress credit professionals should take note.

The Industries with the most distressed bonds and loans