Credit Today ListServe: Snapshot Survey the Customer Bankruptcy Environment

Due to the recent rise in commercial bankruptcies, Credit Today was interested in learning about the experiences credit executives are currently having in regard to customers filing bankruptcy. The predictions in the marketplace are that commercial bankruptcies will continue to rise into next year, so, from a credit department perspective, this survey will be informative concerning the commercial bankruptcy environment.

Executive Summary

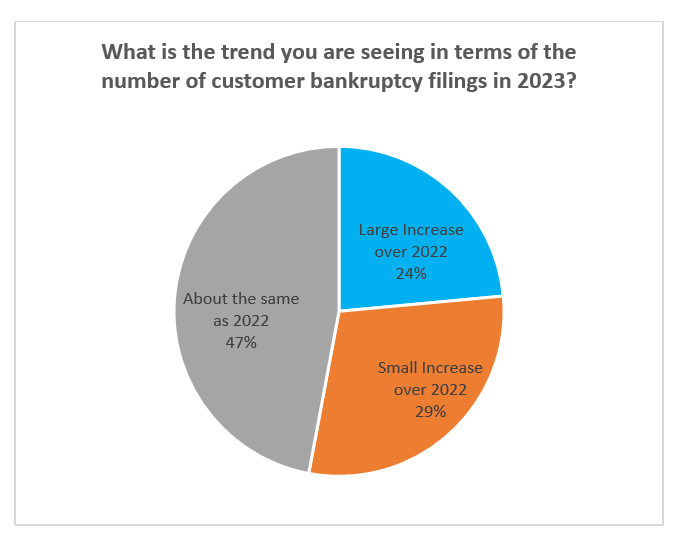

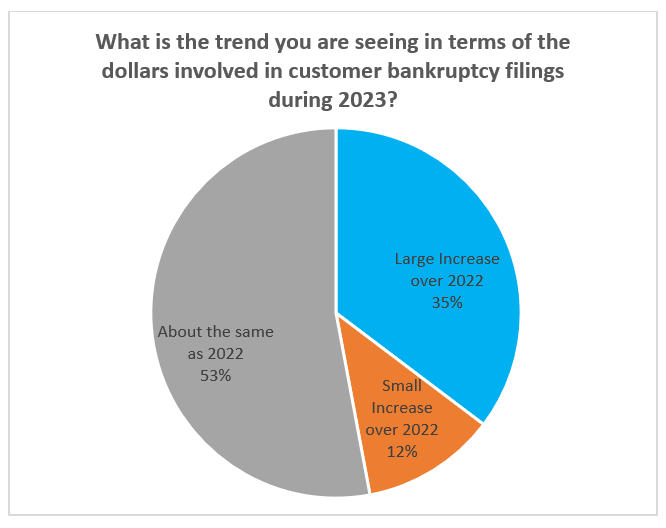

- To some extent, credit managers are seeing an increase in the number of commercial bankruptcy filings and the dollars involved, but roughly half see the situation being similar to last year – nobody is seeing any declines

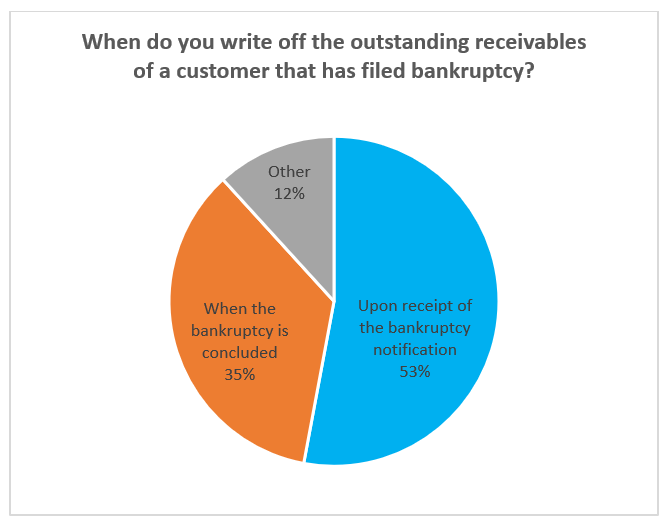

- 53% write off the receivable upon notification of a bankruptcy

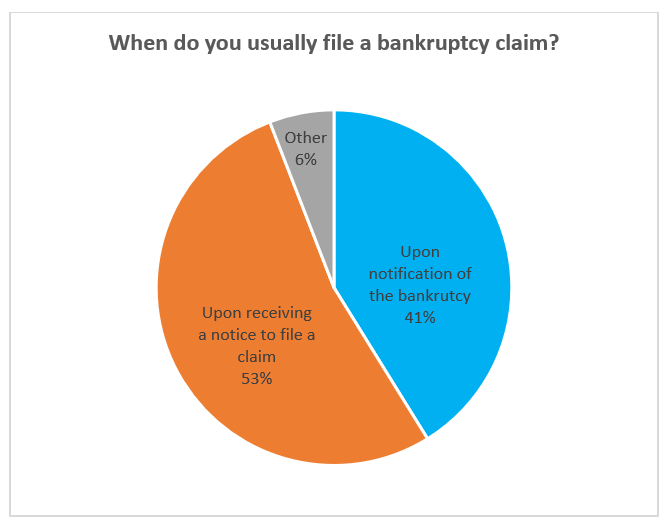

- 53% wait to file a bankruptcy claim until receiving notification from the court that claims should be filed

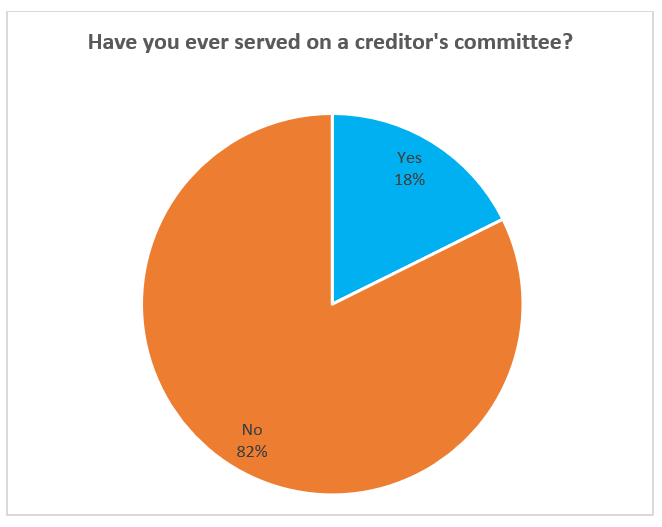

- Only 18% of credit executives have ever served on a creditors committee

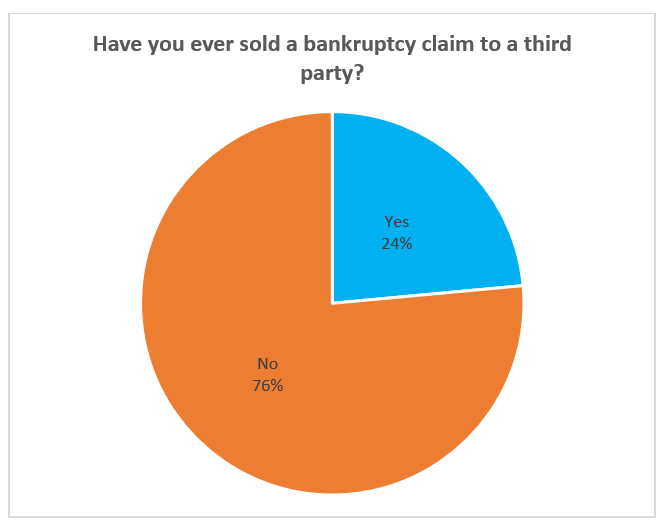

- 24% of credit execs have sold a bankruptcy claim

Observations:

- No participants reported experiencing a decrease in customer bankruptcy filings

- Slightly over half of the participants (53%) reported customer bankruptcy filings had increased

Observations:

- Nobody reported a drop in the dollar size of customer bankruptcy filings

- While over half reported the dollar size to be about the same as last year, of those reporting an increase, about 2 out of 3 stated they were experiencing a substantial uptick in the dollars involved

Observations:

- The most common practice by a sizable margin involves writing off the bankruptcy debt upon notification of the filing

- The "Other” category included:

- 80% upon notification of the bankruptcy filing and 20% upon its conclusion

- One year after notification

Observations:

- There are generally just two schools of thought on filing bankruptcy claims:

- Just over half (53%) wait until being notified that there are assets and a claim should be file

- Most others believe that you should always file a claim as a precaution in case something changes and to avoid missing any notification to file

Observations:

- Serving on a creditors committee is a valuable experience, but less than one in five credit executives have ever done so

Observations:

- Nearly one out of four credit executives have sold a bankruptcy claim

- Selling claims early in the bankruptcy process has a couple of advantages:

- First, you don’t have to wait for payment, which sometimes takes years

- Secondly, bankruptcy claims tend to decrease in value the longer the bankruptcy process takes

Question: Please briefly share with us how you process customer bankruptcy notifications and tell us what you do to monitor ongoing bankruptcy proceedings.

“We utilize PACER to download any related documents. We also receive notifications of documents filed from the claims and noticing agent for a specific bankruptcy. Those forms are then reviewed by our corporate attorneys.” - Carlos Anderson, Credit Manager, Kravet Inc.

“Invoice(s) are written off to bad debt at the time of notification and then filed electronically, attaching a copy of the invoice(s). Credit limit is immediately set to zero. Any orders placed are either funds in advance or credit card after verifying the card.” - Charmaine Lester, Credit Manager, Fusion Incorporated

“Sign up on bankruptcy site to receive updates.” - Anonymous

“Definitely start earlier than later. The sooner recovery attempts are started the better chance of getting paid.” - Pam Byk, Credit Collections Manager, XL Screw Corp

“Usually on websites but also subscribe to PACER.” - David Sayre, Director of Credit, Carpenter Co.

“Turn over to legal counsel.” - Janet L Elliott, Director-Financial Services, Werner Electric Supply Co.

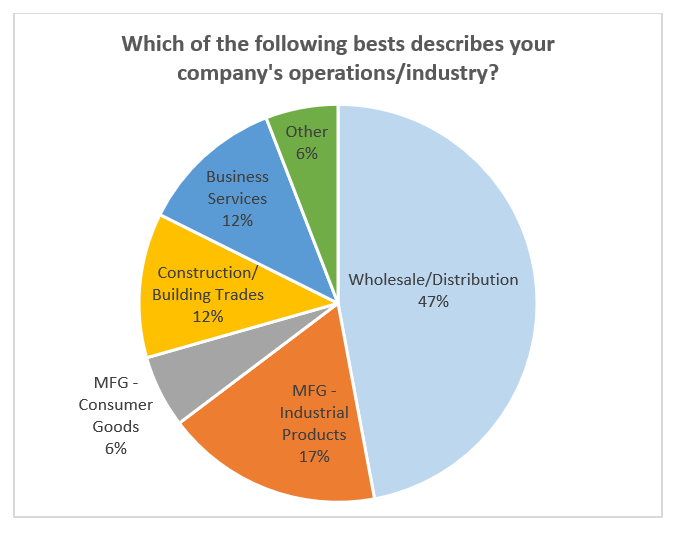

Survey Demographics

Participants = 17