As we are all well aware, Covid brought about a firestorm of logistical problems due to the interruption of established trading channels and greatly affecting supply chains.

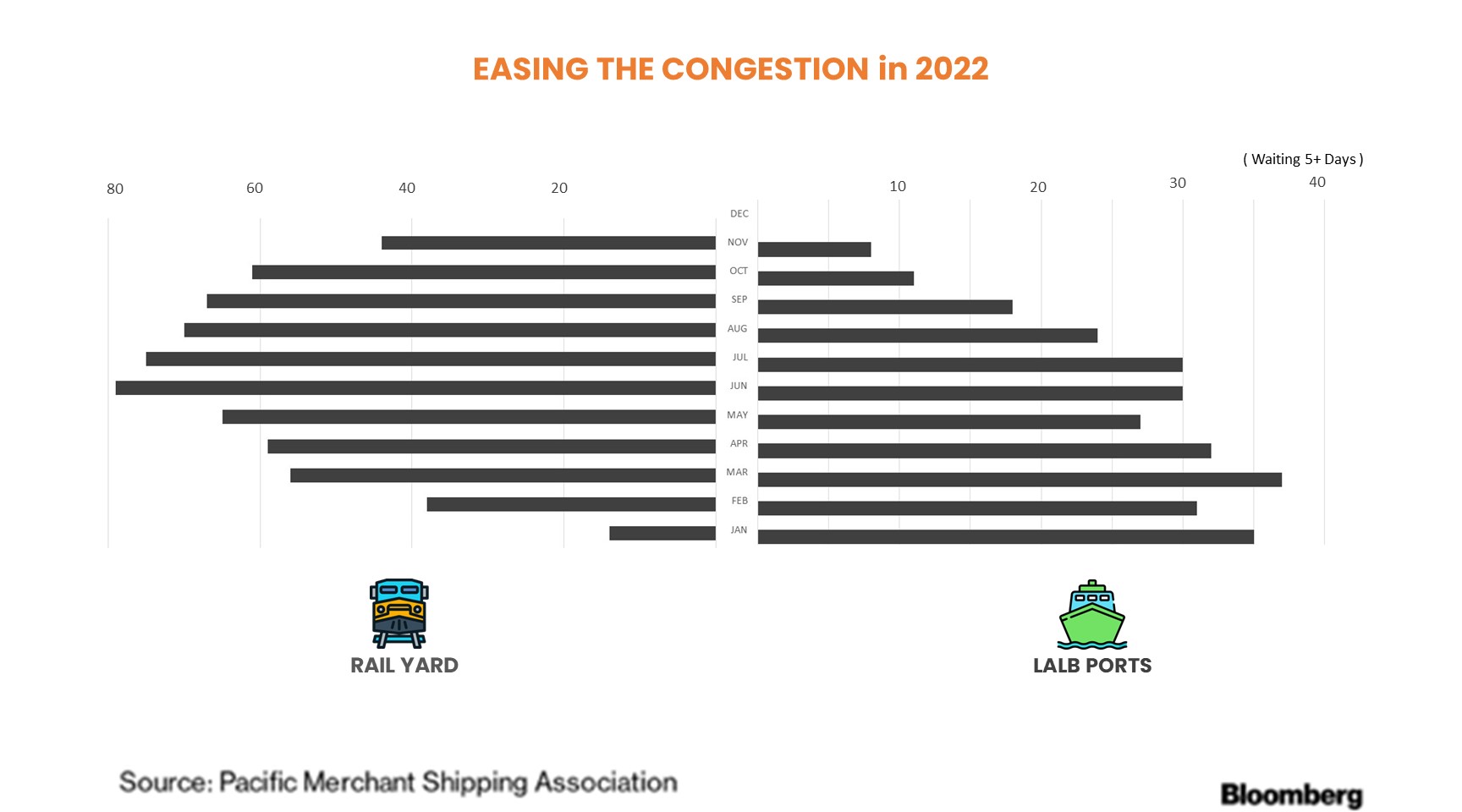

As the following charts illustrate, these issues have largely been resolved and freight is flowing in more normal patterns. The Ports of Los Angeles and Long Beach are no longer the poster child for a logistical nightmare. To a large extent, the merchandise on the docks moved to the railyards, but the evidence shows the worst is over there as well, and things should return to something approximating normal in 2023.

Of course, logistical issues are only one type of supply chain risk. Savvy credit pros should still keep a lookout for plant closures due to natural disasters, strikes, as well as health and safety issues. Inflation and rising interest rates can also lead to shortages along with international conflicts, tariffs, droughts, bird flu, swine flu, mad cow disease, and so much more. If there is anything the last two years should have taught us, it is that as finance executives we should be aware that resiliency, as valuable as it is, is still no match for the law of unintended consequences. Vigilance is therefore often your best defense.