Loan Reserves Are Climbing

By David Schmidt

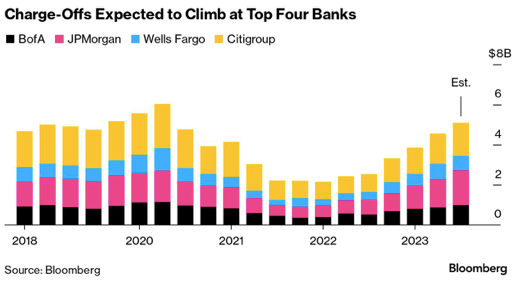

According to research by Bloomberg, the largest US banks – JPMorgan, Citigroup, Wells Fargo, and Bank of America – are expected to experience a significant increase in bad loan write-offs, the highest since the early days of the COVID-19 pandemic. This rise is attributed to persistently higher interest rates and concerns about a potential economic downturn, even though economic data suggests otherwise. Combined, these banks are expected to report approximately $5.3 billion in net charge-offs during the third quarter, a figure more than double what it was a year ago.

CECL (calculated expected credit loss) regulations require creditors to have a standardized method for projecting bad debts. With the close of the current fiscal quarter, these reserves must be recalculated. CECL was implemented for the banks just before Covid struck, so the increases on the following chart for the first 2 quarters of 2020 reflect the adjustments made due to the onset of the pandemic. As the economic stimulus took effect, expected credit losses were largely diminished but have steadily risen as the stimulus funds have been used up.

The current challenges stem from consumers struggling to cope with rising interest rates and the commercial real estate sector dealing with the impact of remote work. While some signs of consumer weakness have been observed, most have managed to handle the rate increases. Business credit managers are well-advised to monitor consumer spending and defaults, which historically have been leading indicators of commercial downturns.