“With almost half our team retiring, the CFO wants a 20% reduction in bad debt!”

Sounds familiar?

In today's rapidly changing business environment, finance leaders are under pressure to deliver more with less. As recession hits, most finance members are being laid off, making it difficult for CFOs to achieve the same ROI while reducing bad debt.

It has become essential for global finance leaders to rethink their approach to working capital management. The solution? Automating your finance processes.

Read this blog to explore how automation could help your finance teams meet their goals, deliver results, and recover working capital.

Chapter 01: Working Capital Woes: Disadvantages of Manual Process

Economic uncertainties like the great resignation and recession have made it difficult to maintain manual, paper-based, and legacy processes.

This leads to challenges like:

- Increase in workload: Manual processes mean that finance teams have to manually input data, which can be time-consuming and error-prone. This creates an additional workload for them.

- Manual prioritization of customer accounts: With a large number of customer accounts to manage, manual prioritization becomes a difficult task, leading to delays in collections and poor working capital management.

- Longer collection cycles: With manual processes, the time it takes to collect payments from customers is longer, leading to poor cash flow and working capital management.

- Poor working capital management: Manual processes and the challenges mentioned above lead to poor working capital management, which can be detrimental to the business's financial health.

Now that the CFO’s spotlight is on all A/R functions, finance leaders should look out for Artificial Intelligence (AI) driven solutions to optimize their working capital.

Chapter 02: Revolutionizing Finance Landscape with AI-Driven Solution

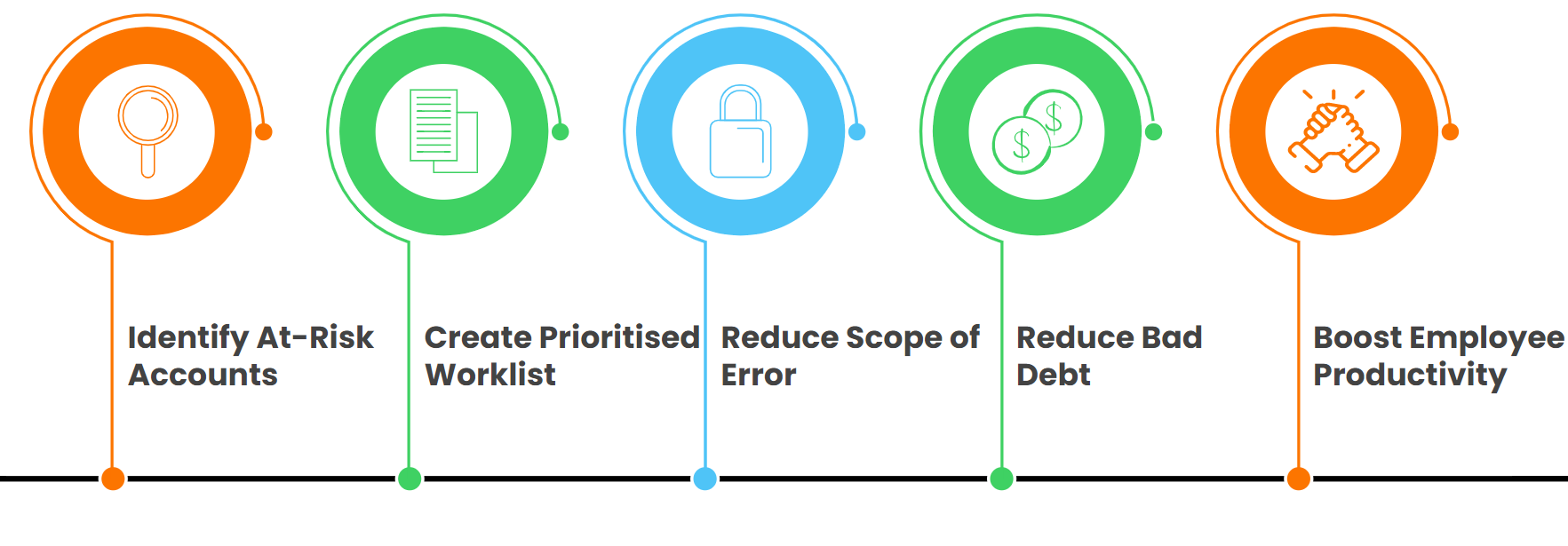

Based on customer credit scores and collection rules defined by your organization, an AI-powered solution can:

- Identify At-Risk Accounts: Automatically identify accounts at risk of delinquency based on customer credit scores and collection rules defined by your organization

- Create Prioritise Worklist: Based on system-configured parameters such as payment history trend and risk score, an AI-powered solution can automatically create a prioritized worklist. This helps to improve cash flow and working capital management.

- Reduce Scope of Error: Automation can link payments to invoices, reducing errors and improving accuracy. This helps to improve cash flow and working capital management.

- Reduce Bad Debt: With automated dunning, finance teams can easily manage overdue invoices and follow up with customers on payment. This helps to reduce bad debt and improve cash flow.

- Boost Employee Productivity: Automating repetitive tasks such as creating P2Ps, notes, and emails frees up collectors' time to focus on higher-priority collection tasks.

The message is clear. Finance leaders seeking a competitive edge should leverage platforms with embedded Artificial Intelligence (AI) capabilities.

Chapter 03: Automation Success Stories: A Game Changer for Working Capital

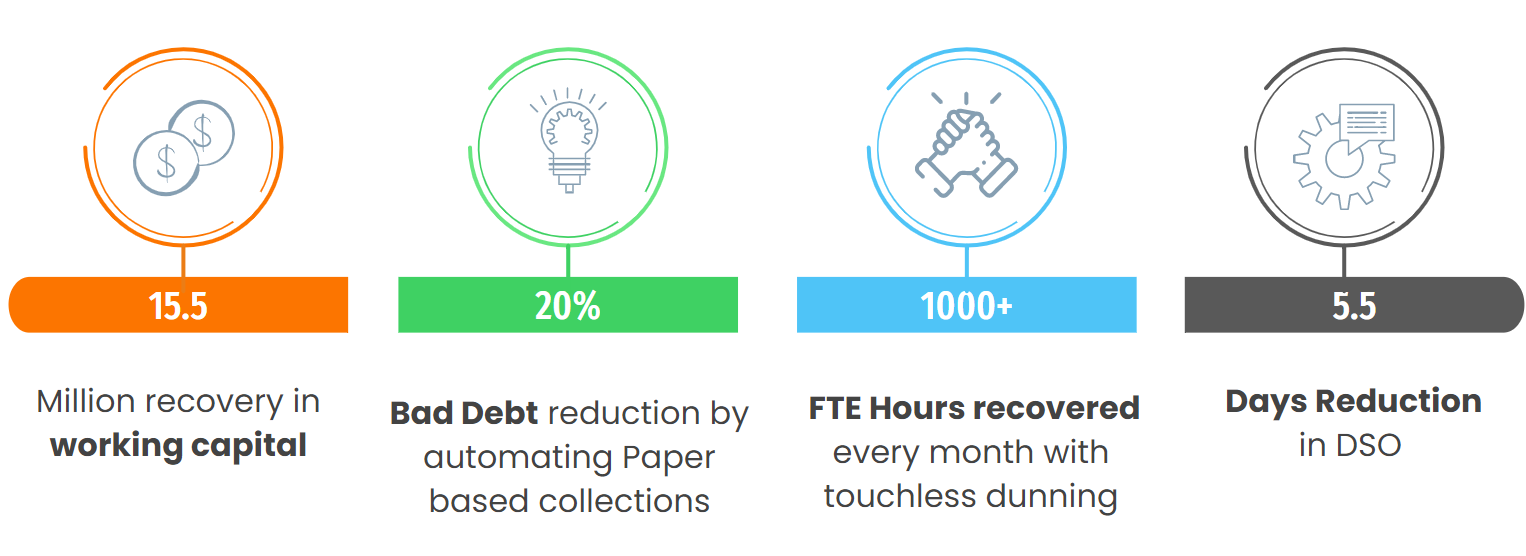

Below are some results achieved by various CPG companies, when they applied AI-driven solutions to improve their performance.

Chapter 04: Conclusion

Automation can revolutionize working capital management in the finance sector. By reducing workload, prioritizing collections, and improving overall efficiency, finance teams can improve cash flow and working capital management.