Same Day ACH Transfers $1.2 Trillion in First Half of 2023 Helping Power the Modern ACH Network

Nacha announces second quarter 2023 ACH Network results, including first half 2023 Same Day ACH results. (Graphic: Business Wire)

July 25, 2023 11:00 AM Eastern Daylight Time

HERNDON, Va.--(BUSINESS WIRE)--The use of Same Day ACH payments grew significantly in the first half of 2023, powering the modern ACH Network to help meet the nation’s needs for faster payments, Nacha reported today.

For the first half of 2023, the value of Same Day ACH payments stands at nearly $1.2 trillion, up 51.7% from a year earlier. The volume of 385.6 million Same Day ACH payments in the first half of 2023 is an increase of 13.7%.

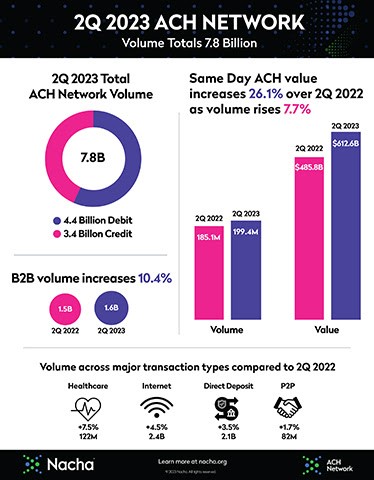

For the second quarter of 2023, there were 199.4 million Same Day ACH payments, up 7.7% from a year earlier. The value of those payments was $612.6 billion, an increase of 26.1%.

“The growth in the volume and especially the value of Same Day ACH payments shows the impact and the benefits of increasing the payment limit in 2022 to $1 million,” said Jane Larimer, Nacha President and CEO. “Whether it’s emergency and unscheduled payroll, insurance claim payments, account transfers or business-to-business payments, these results show that Same Day ACH is a leader in faster payments.”

For the ACH Network overall, growth continued in the second quarter of this year, with 7.8 billion payments transferring $20 trillion. Those are increases of 4.3% and 2.9% respectively over 2022’s second quarter.

Business-to-business (B2B) payments increased 10.4% from a year earlier, to more than 1.6 billion, continuing their double-digit growth trajectory.

“Many businesses and organizations are already aware of the value proposition that ACH payments provide. For others, the growing instances of check fraud should be ample reason to make the switch away from paper in making and receiving B2B payments,” said Larimer.

Claim payments to healthcare professionals increased 7.5% to 122.3 million, as Nacha continues to encourage dental and medical professionals to receive claim payments by ACH.

“Providers work hard and should be receiving their payments safely and quickly using ACH, and avoiding the costs associated with other methods,” said Larimer.

About Nacha

Nacha governs the thriving ACH Network, the payment system that drives safe, smart, and fast Direct Deposits and Direct Payments with the capability to reach all U.S. bank and credit union accounts. There were 30 billion ACH Network payments made in 2022, valued at close to $77 trillion. Through problem-solving and consensus-building among diverse payment industry stakeholders, Nacha advances innovation and interoperability in the payments system. Nacha develops rules and standards, provides industry solutions, and delivers education, accreditation, and advisory services.

Contacts

Dan Roth

Nacha

571-579-0720

media@nacha.org