But the real work only begins once a decision is made on a solution.

Before implementation, you will have to manage a strict well-planned timeline. After implementation, you will have to ensure the return on your company's time and cost investment is offset by the performance results anticipated. But how do you make sure that your efforts to streamline your credit department’s efficiency through automation are a success?

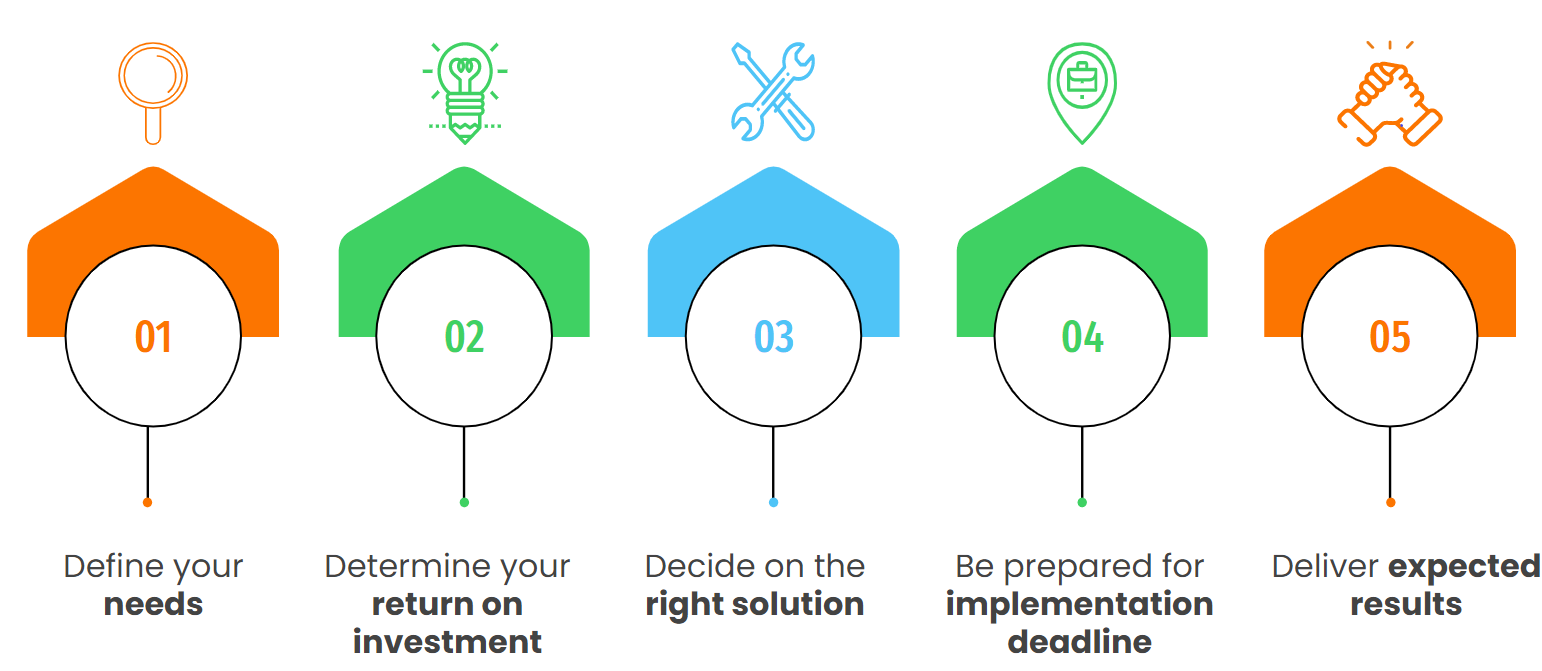

Here are five steps you could follow:

- Define your Needs: First benchmark, and understand your company and department needs. Consider how the workflows, reporting, and tools will impact your stakeholders. You could meet your customer service, sales, finance, and senior management. Once you have a detailed list of requirements, prepare a Request for Proposal (RFP) in preparation for a software vendor review.

- Determine the return on the investment: Any system implementation requires funding. It might be the most difficult step. It requires a compelling project justification to get the buy-in of your department, stakeholders, and senior management. In fact, the expected return should be much more than what was budgeted. You need to take a hard look at which of the following may be applicable to your company:

Potential cost savings:

- Efficiency improvements reduce overhead costs.

- Staff redeployment, or reduction in headcount.

- For a growing company, the avoidance of future staff additions.

- Visibility and control of company inflows and outflows.

- Increased accounts receivable turnover leading to a lower DSO and improved cash forecasting, can reduce the need for your company to borrow, reducing interest expense.

- Improved order-to-cash workflows and process controls.

Improved Customer service:

- Tailored and timely communication with customers.

- Credit decision tools and timeliness.

- Timely Deduction management workflows, and identification and correction of root issues driving invoice errors.

- Cash application.

- Performance reporting and tracking.

A cleaner AR portfolio will attract better lending terms.

- Decide on the right solution:

- Research potential software providers and determine which solution best addresses your company's needs.

- Send a Request for Proposal to the software providers most likely to meet your company's requirements.

- Use your network contacts to develop an understanding of which software providers have capabilities best fitting your industry, company size, and complexity.

- Create and distribute a Request for Proposal (RFP) detailing your company's specific needs. Include a final submission date and where submissions should be sent. It is a good idea to require an original response to each question, and responses including canned marketing materials will be rejected.

- Evaluate each software provider that responds to the RFP

- Invite each software provider responding to the RFP for a live demonstration of each functional area of interest.

1. In advance provide sample data so the demo relates to your company.

2. Invite your team and stakeholders who will be impacted by the new automation.

- Have a ready set of questions during the demo and evaluation stage

- What customizations will be needed to adapt to your particular needs?

- What is the level of experience in your industry or companies with a similar footprint?

- What is their pre-launch process?

- What sort of on-site evaluation do they do?

- How do they handle user training both before and after implementation?

- Understand the workflow capability for credit approvals, holds, deductions/disputes, etc.

- How often is the software updated? How will your company remain on the most current revision? What is the cost?

- What is the time/involvement required of your staff? IT staff, etc.?

- How do they price? What is the cost: Pre-implementation professional fees. Training and post-implementation support? Service? Per user (primary and casual), site license, transaction?

- Be prepared for the implementation deadline:

- Consolidate and clean the Customer Master—correct any redundancies, or inaccurate information before the implementation.

- Involve users in your department and others who will be involved so they understand the changes, and their role in new workflows and information available.

- Get all users to buy into the changes.

- Train all users.

- Test before you implement.

- Deliver expected results:

- Identify and resolve bugs as soon as they are identified.

- Review how users are adopting the functionality and benefits of the new tools. User adoption of new ways of doing things may take repetitive reinforcement and training.