From a computing perspective, some feared, and the media spread the hype, that computers around the world would turn the clocks back to 1900 rather than ahead to 2000, causing havoc with utilities, scheduling, government benefits, accounting records, and so on…lions and tigers and bears, oh my!

At that time, many companies relied upon legacy accounting systems or software packages that either internal programmers or consultants had built or heavily modified to fit their company's business model. Consequently, there was a rush to become Y2K compliant.

To solve the Y2K problem, some corporations purchased new accounting software packages or moved up to an ERP (Enterprise Resource and Planning) solution, while others installed software patches. Once Y2K passed, and the power of ERP systems was demonstrated, many replaced their legacy systems and moved into the ERP universe. Even so, some legacy systems survived along with the newer, what are today, conventional software platforms.

Legacy 2.0 and Digital Transformation

Fast forwarding to the present, many of the new software implementations that resulted from Y2K remain in service. These are today's legacy systems. The reasons they are still in service are threefold:

The more a software package is modified, the more expensive it becomes to move to an upgraded version -- many who replaced their legacy systems turned around and began replicating the pitfalls of their legacy systems by heavily modifying their new computing platforms.

The rise of bolt-on software solutions that address functions not covered by the primary business software package further complicated the upgrade process -- now you must deal with both the primary business system as well as the bolt-ons in any upgrade.

New software installations are both expensive and disruptive. In the short term, it is much easier and less expensive to keep tweaking a legacy system.

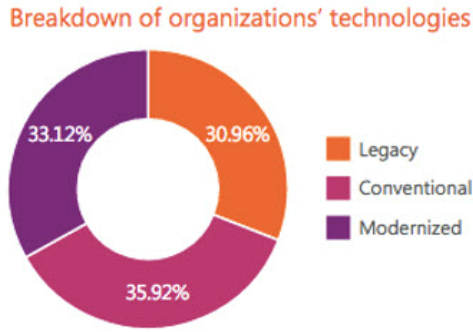

Analysis of the average breakdown across respondents' organization's application portfolio, infrastructure deployments and workplace technologies; all respondents (800).

Legacy systems, because of their outdated technology and general unwieldiness (by today's standards), present a challenging barrier to digital transformation, as do more recent conventional systems that were not built to Modern Software Engineering (MSE) standards.

The biggest failure of legacy technology is its inability to provide access to pertinent data. Legacy systems trap information in silos rather than deliver a single and simple-to-use source of truth -- in real-time. Any mishmash of conventional and legacy systems will hinder lateral collaboration.

A buzzword that is now being frequently discussed in IT circles is digital transformation. It's become a high priority at both the board level as well as in the C-suite. Digital transformation promises new heights in terms of corporate agility, but at the same time, if you aren't able to implement these changes soon, your company will be at a serious disadvantage to your more agile competitors. There is ample research that backs up this contention:

1. Couchbase, an advanced database platform provider, revealed in its annual CIO survey that nearly 90 percent of companies have problems with their legacy system: 50 percent had at least one digital project fail, 25 percent were forced to reduce the scope of a project, while an additional 13 percent suffered significant delays because their legacy database technology couldn't support their needs. Furthermore, 86 percent of CIOs claimed their "ambitions to use data for new digital services" were being held back, with the top two reasons being 1) the complexity of working with multiple technologies (43 percent) and 2) a reliance on legacy database technology (37 percent).

2. A research study of 800 senior IT managers sponsored by information technology and services giant Avanade revealed that just 33 percent of existing systems are comprised of modern technologies, with nearly half (47 percent) housed on-site. Furthermore, nearly two-thirds (65 percent) deem conventional systems and approaches unfit to meet the parameters necessary to support digital transformation. This study also found that modernization could be expected to lift annual revenue by 14.4 percent while cutting costs by 13.6 percent.

Simply stated, it is difficult to innovate if your computing environment has a legacy basis. While bolt-on solutions can provide state-of-the-art process automation for most of the order-to-cash process, there are likely to be gaps or peripheral processes that are not covered. Also, the order-to-cash process can still become a functional "silo," albeit a much broader silo than the ones it spans. As a result, you won't realize the same scalability and flexibility to continue to innovate as you would if the legacy system had been replaced.

Enter Modern Software Engineering ("MSE")

MSE applies advanced technologies for configuring software systems to capture and interpret existing applications for processing a transaction, manipulating data, triggering responses, and communicating with other digital systems or end users. In addition to using Artificial Intelligence (AI), MSE can deploy the following automation processes to develop transformative solutions:

- Robotic process automation: Used to automate repetitive tasks and eliminate manual labor.

- Intelligent automation: Utilizes the data and patterns of past activities to recommend actions based on predicted future behavior.

- Cognitive automation: Relies on self-learning systems that incorporate data mining, pattern recognition, and natural language processing to mimic human interactions.

Edge computing, virtual and augmented reality, as well as blockchain and mobile technologies round out the tools involved in MSE.

Making the Case For Upgrading: Three Key Reasons

There are many reasons to upgrade, but the most compelling ones involve keeping your company competitive, secure, and up-to-date with regulations.

1. Multiple studies suggest that the top motivator for embarking on digital transformation is keeping up with or surpassing advances made by competitors.

2. The security risks inherent in a patchwork of legacy or conventional software solutions provide another strong impetus for upgrading core software systems.

3. Regulation often provides another catalyst for innovation. In the past Gramm-Leach-Bliley and Dodd-Frank legislation spurred many corporations to replace their legacy systems. As the regulatory environment continues to grow worldwide (think PCI, GDPR, CECL, etc.), legacy systems will be increasingly burdened and the compliance fixes increasingly expensive while seldom exceeding adequacy in terms of performance. The new technologies involved in MSE take down functional silos, providing a single source for insights, higher levels of security, and comprehensive audit trails while being much more cost-effective in the long term.

Opportunities for Credit Executives

Credit Execs who find themselves frustrated by the limitations of their organization's computer systems should seek out opportunities to participate in any modernization the company may embrace. Too often, credit is the last party to the table when software decisions are being made.

Part of the reason for that may be that Finance Departments are less likely to pursue innovative technologies in comparison to Marketing, Logistics, and Sales. The Couchbase survey found improved customer experience (56 percent), more efficient working processes (53 percent), and increased worker productivity (49 percent) to be the top three benefits of modernization. And Marketing, Logistics, and Sales have a much bigger stake in the customer experience than Finance.

All this suggests that credit execs need to find a way out of the backwater of finance. Here are three courses of action you might consider taking:

1. Find out your organization's IT roadmap

2. Identify the IT roadblocks getting in the way of better AR performance

3. Network with other functions within your organization that are also being held back by legacy systems

If you cannot find out the IT roadmap from your CFO or the firm's CIO, find a lower-level IT staff member that will share the information. Chances are your IT Department is promoting modernization to the C-suite (or vice-versa) and will welcome your contributions.

Once you know the roadmap you can better position yourself to be a participant. The Avanade study indicates more than 3 out of 4 senior IT executives have already deployed or expect to deploy new process automation technologies within 36 months, so there may even be a place for your credit improvement ambitions in the IT roadmap if you play your cards right.

That involves being able to communicate how the credit organization has outgrown your legacy systems. A good place to start is the issues caused by system weaknesses that are affecting credit department performance. Some common problems you might face include hindrances to cash applications, deduction handling problems, and new customer approvals.

Furthermore, it has been over a decade since the last economic downturn, so we are long overdue. When one occurs, many organizations may be caught by surprise and will find their current credit and collection systems inadequate to the level of risk monitoring and remediation needed to avoid major bad debt losses. Modernized systems could go a long way to mitigating this economic risk and as such return a very attractive return on investment (ROI).

Once you have identified the ways modernization can benefit the credit function, you will need to quantify those advantages. Getting a handle on the ROI is another area where a relationship with IT can be mutually beneficial. It's critical that you are able to validate your recommendations for modernization by quantifying the benefits of increased functionality, flexibility, and integration.

You will also find other functions are frustrated by legacy systems' limitations. There is a lot of chatter in the Treasury profession about digital transformation, with experts predicting a wave of transformative modernization over the next 24 months. Treasury requires real-time visibility into all cash positions to facilitate liquidity and free up working capital.

Enhancing the customer experience, as previously mentioned, is also a high priority in many organizations. The credit function is sitting on a wealth of customer information, so there may also be networking opportunities with sales, marketing, and customer service to deliver innovative insights.

The bottom line is that credit executives need to get involved outside the credit function in order to attain a better perspective on how credit is aligned with corporate objectives.

Initiative pursued the right way, is usually viewed favorably by most organizations (if not, maybe it's time to clean up your resume). By thinking out of the box and being proactive, you have an opportunity to get an early seat at the table when it comes to the IT roadmap and AR performance innovations, thereby ensuring that credit is not left behind during the next round of IT infrastructure enhancements.